Business Daily from THE HINDU group of publications

Monday, Sep 08, 2008

ePaper | Mobile/PDA Version | Audio

Perspective

Opinion - Social Security

Money & Banking - Pension Plans

Banking on consensus

C. N. Venugopalan

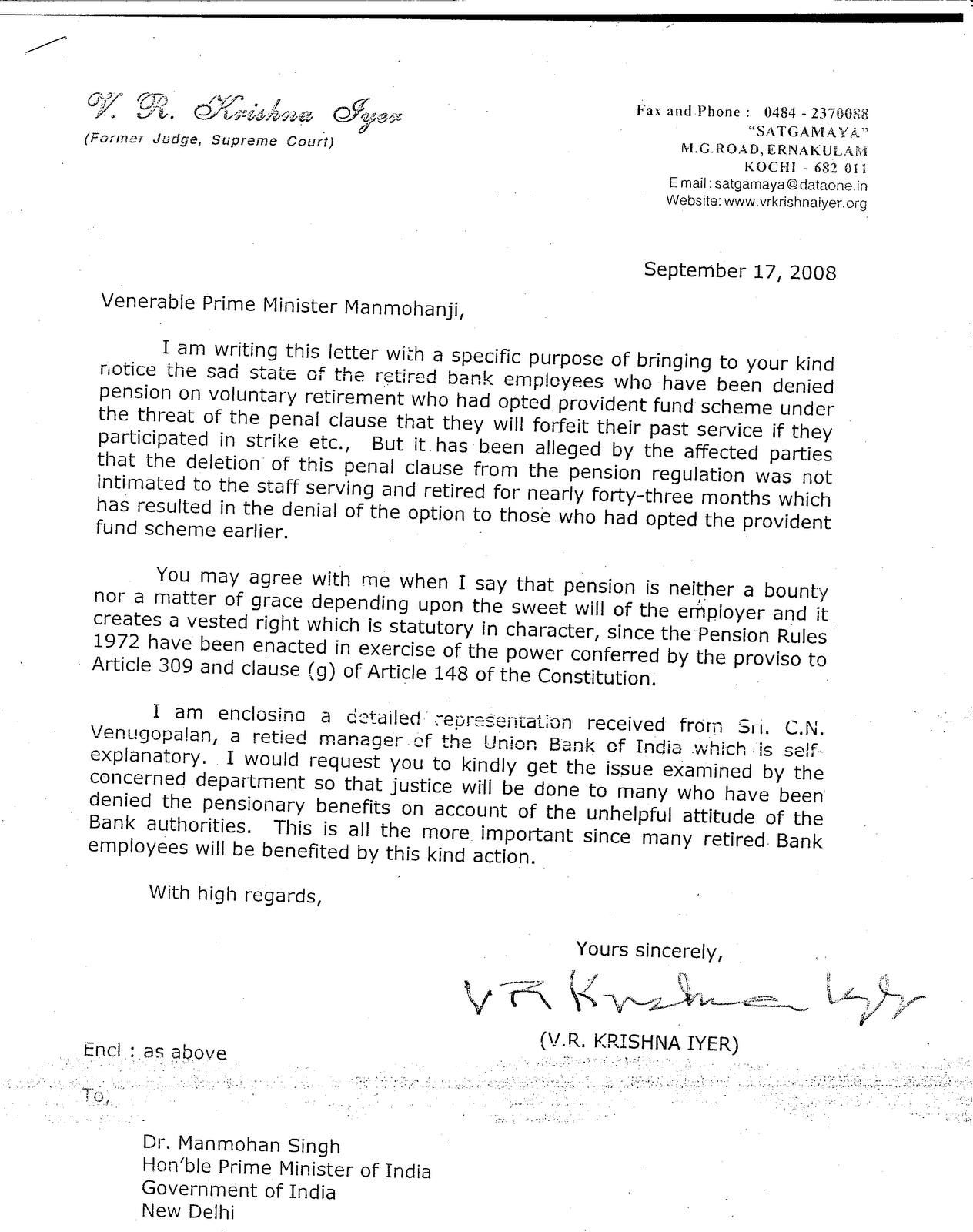

The pension scheme in banks does not cover about 70 per cent of the employees working in the industry. The understanding between the Indian Banks’ Association (IBA) and bank unions in March 2008 to finalise extension of fresh option for pension within three months is yet to be implemented.

Based on the pension scheme for Central Government employees, pension was introduced in banks in 1995. The scheme extended coverage to all those who retired from banks on January 1, 1986, by taking back from them the contributory PF (employer’s share) paid to them at the time of retirement, together with 6 per cent interest.

It further extended compulsory coverage to those recruited after the commissioning of the scheme without any contribution from them to the Pension Fund. It remains ironical that the majority of employees who were in service at the time of inception of the scheme are denied the benefit.

The pension scheme contained a provision vesting banks with the right to forfeit the entire past service of an employee if he participated in a strike. The final regulations also called afresh for an option to be exercised before a further date in case of those who did not opt earlier.

Consequent on trade union pressure, banks later deleted the forfeiture clause in February 1999, but did not extend a fresh option to the employees in the wake of the amendment, to those who revoked their options or did not join the scheme on account of the deleted harsh clause. Banks confined the amendment to mere gazette publication, keeping it in camera. Trade unions that got the clause removed from the regulations failed to secure for members a second chance to exercise an option to which they were legally entitled when the offer terms changed.

Not legally maintainable

After publishing the final regulations, banks gave employees a chance to revoke the options exercised in response to the draft regulations upon advice from the IBA. The regulations had categorically stated that an “option once exercised shall be final and irrevocable” and nowhere contained a provision for revocation of an exercised option.

Since the IBA has no powers exceeding that of the board of banks or the Central Government that sanctioned the scheme, the revocation done at its behest is not legally maintainable. Paucity of funds to meet additional financial burden is claimed as a reason for not extending fresh option. The question that pops up is “what would banks have done if all had opted for it when offered?”

Granting a second option for pension with retrospective effect to all those on the rolls in February 1999 is mere compliance with the requirements of law and not an extension of a fresh benefit. Banks, Government and trade unions should reach a consensus on the issue and settle it expeditiously to render justice to employees, retired and working, who have the prescribed qualifying service.

(The author is Vice-President, Union Bank of India Retired Officers’ Association — Kerala.)

More Stories on : Social Security | Pension Plans

Article E-Mail :: Comment :: Syndication :: Printer Friendly Page

________________________________________

The Hindu Group: Home | About Us | Copyright | Archives | Contacts | Subscription

Group Sites: The Hindu | The Hindu ePaper | Business Line | Business Line ePaper | Sportstar | Frontline | The Hindu eBooks |

Wednesday, September 30, 2009

Articles Press donot publish

C N Venugopalan

Ex-Manager, Union Bank of India

Nandanam

Kesari Junction,

N Parvoor,

Kerala – 683 513

Phone. 0484 2447994 Mob: 9447747994 E-Mail: ceeyenvee@gmail.com

No. 20090926 26th Sept., 2009

Editor/Officer-in-Charge,

My Times My Voice

Dear Sir,

Facts and Fables

The ethnic prejudice against bankers, deep-rooted in the minds of the Indian society, holds no longer valid. The most alluring white collar job of the past in the society, in course of time, turned out to be the one of the low paid jobs during the past four decades. Mounting volume of work and accountability aspect not commensurate with the compensation made it a lack luster one resulting in talent drain in the key industry.

Pay of bank officials in the late sixties and the seventies of the last century was far in excess of that to the government officials. Bias culminated in the minds of the latter had the result of implementing the Pillai Committee Recommendations in 1979 for standardizing the pay and allowances of bank officials. The subsequent three decades witnessed apparent erosion in wages in banks. While Pay Commissions constituted by Government recommended timely reasonable increase to the Government employees, the term of wage settlement which used to be four years was stretched to five years in banks saying that it would facilitate speedy implementation of revision on expiry of each settlement. The net result was that in place of five pay revisions over a period of 20 years, only four revisions could take place. The delay for concluding fresh pact on expiry of the current one continues as such. The ongoing wage talks in the industry is in respect of the period from November, 2007. It is not yet concluded leaving the period of interregnum to nearly two years.

Another category of bank employees stranded in life are the retired who are not paid Pension, a pittance which is the sole meager income payable on cessation of employment and salary. Wrong banking equations, arbitrary implementation of agreements and breach of written down Regulations played havoc with the destiny of about 60 k retired employees. Majority of employees now on rolls of banks other than SBI are also denied entry into the Pension Scheme till now. Banks that formulated innovative schemes like “Reverse Mortgage” to benefit the old aged who are not cared by their descendants cut a sorry picture for themselves when they neglect the people who worked for them for years to make them what they are. It is ironical that banks which originated out of some law or other and carry out each and every operation on the premises of substantive law breach their own written down agreements in untoward ways.

Banks extended to employees a chance to opt for Pension, keeping in the Regulations a clause that enabled them forfeit his entire past services in case of his participation in any strike. The harsh stipulation in the Final Pension Regulations meant that one would not get his Pension (as also his CPF which had to be surrendered to the Pension Fund of Banks) if the bank any time forfeited his past service. It prompted majority of employees to stay away from Pension Scheme in 1995 when option was called for. Though the provision was scrapped on 27th February, 1999, no fresh chance of option was extended to those who could not opt when the deleted clause was present. Moreover banks violated the norms of informing the target group about the amendment prior to publication in gazette and kept it in the camera for about 43 months. Banks further revoked the options of some employees which were exercised in terms of the draft Pension Regulations published earlier not with standing the fact that the draft as also the Final Regulations sanctioned by Central Government vividly stated that options once exercised were final and irrevocable. This was done at the behest of IBA which had no authority to intercept the authority of the Government or of boards of Banks. The Regulations never contained an enabling provision for revocation of an exercised option which was final in character.

Even as substantive law mandates extension of fresh option bank unions are making a mockery by asking it as “second option”. They could not be of any assistance to the retired who went out sans Pension. Though several retired took recourse to legal steps, none could secure the legitimate right.

Rift and rivalry among unions stood in the way of securing to the members the legitimate and cardinal right which is akin to fundamental rights of a citizen. Unions that strongly advocated Pension and asked all to opt for it were keen to ensure that their rivals who opposed it never get a chance again. The latter stuck to their stand that CPF was still beneficial even on knowing well that was otherwise. Though the amendment of February, 1999 vested with every employee a right to fresh option, this was not pursued until 2007. The demand lists did not contain the item of Pension Option all along making the issue stale and unenforceable. Government, in the meantime stated that the matter would not be reviewed. Courts paid focus to “paying capacity of banks” rather than the merits of the petitions to the disadvantage of the victims. Pension ultimately became a shattered dream of the bank employee for ever.

The author had been calibrating efforts for about eight years by approaching different authorities including Court to secure the lost social security benefit to the bank employee. When it occurred to him that courts can not be of any assistance in the matter, he propagated countrywide as to how and why all were eligible for fresh option and how they lost their right for making them performing on it. The item which had disappeared from the agenda and charter of demands of Unions for seven years started figuring again in lime light since 2007. Consequent on four or five strike actions, IBA and Unions reached a MOU on 25th February, 2008 to settle the item within three months. Lethargy swept over again resulting in non-adherence to the time schedule by another 18 months to restore the already sanctioned benefit which banks snatched away from employees. It got mixed up with the Wage Revision that fell due in the meantime giving banks leverage for a bargain for a low pay hike on the plea of Pension burden. Banks that make huge profits sought employees to share the burden of Pension which they are to bear as it is recognized by courts as deferred wages. Unions became a major hurdle and stumbling block to the retired for getting their means of life.

Constitution of Pension Fund envisaged contribution of 10 percent of pay of each employee from the banks and interest on it from time to time. Bur after transfer of the then available CPF (employer’s share) in respect of those who joined the scheme in 1995, banks did not continue the contribution to the Fund. Likewise, in respect of fresh recruits who were given compulsory coverage of Pension also, no contribution was made to the Fund. Establishment expenses got converted into profits and kept as reserves or distributed as dividends all along for 14 years in breach of the Regulations. Bringing back the amount would augment the Pension Funds of banks and make possible payment of Pension to all retired employees without sustaining any financial burden.

The formidable task ahead of Unions is to establish parity in pay packet of bank employees by ensuring uniform compensation for labour in the key industry in line with the principles of equity and equality enshrined in the Constitution of India. Payment of higher compensation in SBI and a lower one in the rest of the Public Sector Banks, three retirement benefits viz. Gratuity, CPF and Pension in the former vis-à-vis two viz. Gratuity and Pension or CPF in the rest of the banks etc. are real challenges to be answered by Unions if they are to get a facelift. Discrimination perpetrated by government owned banks in compensating labour by extending different pay packets to people doing identical work is a matter to be examined by the people and government especially when the ultimate burden is borne by the tax payer in the case of PSBs. IBA should garner cordial industrial relations by extending reasonable pay hike to bank employees to avert agitations and Unions should approach an open minded approach to the genuine requirements of employees.

Thanking You,

Yours faithfully,

C N Venugopalan

The Times of India is vested with the right to make amendments to any portion including title for publishing suitably.

Ex-Manager, Union Bank of India

Nandanam

Kesari Junction,

N Parvoor,

Kerala – 683 513

Phone. 0484 2447994 Mob: 9447747994 E-Mail: ceeyenvee@gmail.com

No. 20090926 26th Sept., 2009

Editor/Officer-in-Charge,

My Times My Voice

Dear Sir,

Facts and Fables

The ethnic prejudice against bankers, deep-rooted in the minds of the Indian society, holds no longer valid. The most alluring white collar job of the past in the society, in course of time, turned out to be the one of the low paid jobs during the past four decades. Mounting volume of work and accountability aspect not commensurate with the compensation made it a lack luster one resulting in talent drain in the key industry.

Pay of bank officials in the late sixties and the seventies of the last century was far in excess of that to the government officials. Bias culminated in the minds of the latter had the result of implementing the Pillai Committee Recommendations in 1979 for standardizing the pay and allowances of bank officials. The subsequent three decades witnessed apparent erosion in wages in banks. While Pay Commissions constituted by Government recommended timely reasonable increase to the Government employees, the term of wage settlement which used to be four years was stretched to five years in banks saying that it would facilitate speedy implementation of revision on expiry of each settlement. The net result was that in place of five pay revisions over a period of 20 years, only four revisions could take place. The delay for concluding fresh pact on expiry of the current one continues as such. The ongoing wage talks in the industry is in respect of the period from November, 2007. It is not yet concluded leaving the period of interregnum to nearly two years.

Another category of bank employees stranded in life are the retired who are not paid Pension, a pittance which is the sole meager income payable on cessation of employment and salary. Wrong banking equations, arbitrary implementation of agreements and breach of written down Regulations played havoc with the destiny of about 60 k retired employees. Majority of employees now on rolls of banks other than SBI are also denied entry into the Pension Scheme till now. Banks that formulated innovative schemes like “Reverse Mortgage” to benefit the old aged who are not cared by their descendants cut a sorry picture for themselves when they neglect the people who worked for them for years to make them what they are. It is ironical that banks which originated out of some law or other and carry out each and every operation on the premises of substantive law breach their own written down agreements in untoward ways.

Banks extended to employees a chance to opt for Pension, keeping in the Regulations a clause that enabled them forfeit his entire past services in case of his participation in any strike. The harsh stipulation in the Final Pension Regulations meant that one would not get his Pension (as also his CPF which had to be surrendered to the Pension Fund of Banks) if the bank any time forfeited his past service. It prompted majority of employees to stay away from Pension Scheme in 1995 when option was called for. Though the provision was scrapped on 27th February, 1999, no fresh chance of option was extended to those who could not opt when the deleted clause was present. Moreover banks violated the norms of informing the target group about the amendment prior to publication in gazette and kept it in the camera for about 43 months. Banks further revoked the options of some employees which were exercised in terms of the draft Pension Regulations published earlier not with standing the fact that the draft as also the Final Regulations sanctioned by Central Government vividly stated that options once exercised were final and irrevocable. This was done at the behest of IBA which had no authority to intercept the authority of the Government or of boards of Banks. The Regulations never contained an enabling provision for revocation of an exercised option which was final in character.

Even as substantive law mandates extension of fresh option bank unions are making a mockery by asking it as “second option”. They could not be of any assistance to the retired who went out sans Pension. Though several retired took recourse to legal steps, none could secure the legitimate right.

Rift and rivalry among unions stood in the way of securing to the members the legitimate and cardinal right which is akin to fundamental rights of a citizen. Unions that strongly advocated Pension and asked all to opt for it were keen to ensure that their rivals who opposed it never get a chance again. The latter stuck to their stand that CPF was still beneficial even on knowing well that was otherwise. Though the amendment of February, 1999 vested with every employee a right to fresh option, this was not pursued until 2007. The demand lists did not contain the item of Pension Option all along making the issue stale and unenforceable. Government, in the meantime stated that the matter would not be reviewed. Courts paid focus to “paying capacity of banks” rather than the merits of the petitions to the disadvantage of the victims. Pension ultimately became a shattered dream of the bank employee for ever.

The author had been calibrating efforts for about eight years by approaching different authorities including Court to secure the lost social security benefit to the bank employee. When it occurred to him that courts can not be of any assistance in the matter, he propagated countrywide as to how and why all were eligible for fresh option and how they lost their right for making them performing on it. The item which had disappeared from the agenda and charter of demands of Unions for seven years started figuring again in lime light since 2007. Consequent on four or five strike actions, IBA and Unions reached a MOU on 25th February, 2008 to settle the item within three months. Lethargy swept over again resulting in non-adherence to the time schedule by another 18 months to restore the already sanctioned benefit which banks snatched away from employees. It got mixed up with the Wage Revision that fell due in the meantime giving banks leverage for a bargain for a low pay hike on the plea of Pension burden. Banks that make huge profits sought employees to share the burden of Pension which they are to bear as it is recognized by courts as deferred wages. Unions became a major hurdle and stumbling block to the retired for getting their means of life.

Constitution of Pension Fund envisaged contribution of 10 percent of pay of each employee from the banks and interest on it from time to time. Bur after transfer of the then available CPF (employer’s share) in respect of those who joined the scheme in 1995, banks did not continue the contribution to the Fund. Likewise, in respect of fresh recruits who were given compulsory coverage of Pension also, no contribution was made to the Fund. Establishment expenses got converted into profits and kept as reserves or distributed as dividends all along for 14 years in breach of the Regulations. Bringing back the amount would augment the Pension Funds of banks and make possible payment of Pension to all retired employees without sustaining any financial burden.

The formidable task ahead of Unions is to establish parity in pay packet of bank employees by ensuring uniform compensation for labour in the key industry in line with the principles of equity and equality enshrined in the Constitution of India. Payment of higher compensation in SBI and a lower one in the rest of the Public Sector Banks, three retirement benefits viz. Gratuity, CPF and Pension in the former vis-à-vis two viz. Gratuity and Pension or CPF in the rest of the banks etc. are real challenges to be answered by Unions if they are to get a facelift. Discrimination perpetrated by government owned banks in compensating labour by extending different pay packets to people doing identical work is a matter to be examined by the people and government especially when the ultimate burden is borne by the tax payer in the case of PSBs. IBA should garner cordial industrial relations by extending reasonable pay hike to bank employees to avert agitations and Unions should approach an open minded approach to the genuine requirements of employees.

Thanking You,

Yours faithfully,

C N Venugopalan

The Times of India is vested with the right to make amendments to any portion including title for publishing suitably.

Subscribe to:

Posts (Atom)