Dear Comrades,

Banking System fully loaded with Fake Currency

On 2008 March 6 by the then Finance Minister stated as follows

(Financial Express on 7th March, 2007)

The minister added that RBI governor Y V Reddy has told the board that the central bank was “fully geared to support the government in implementing the scheme in a manner that the banking sector will be strengthened, not weakened.”

This is the new theory propounded by Shri. P Chidambaram that may make him a Nobel laureate for Economics. He explored the banking system to be strong enough to bear the burnt of Rs.60,000 Crores without feeling a pinch. And the banking system did not suffer in any way in the process of extending the benefit of loan waiver to defaulters. The fools who repaid loan honestly are people who were made gullible. Long live Chidambaram. Long live his incredible theory. Shri. Reddy had hiccough of a severe nature on the day and hence the magnanimous FM came to rescue him as his mouth piece.

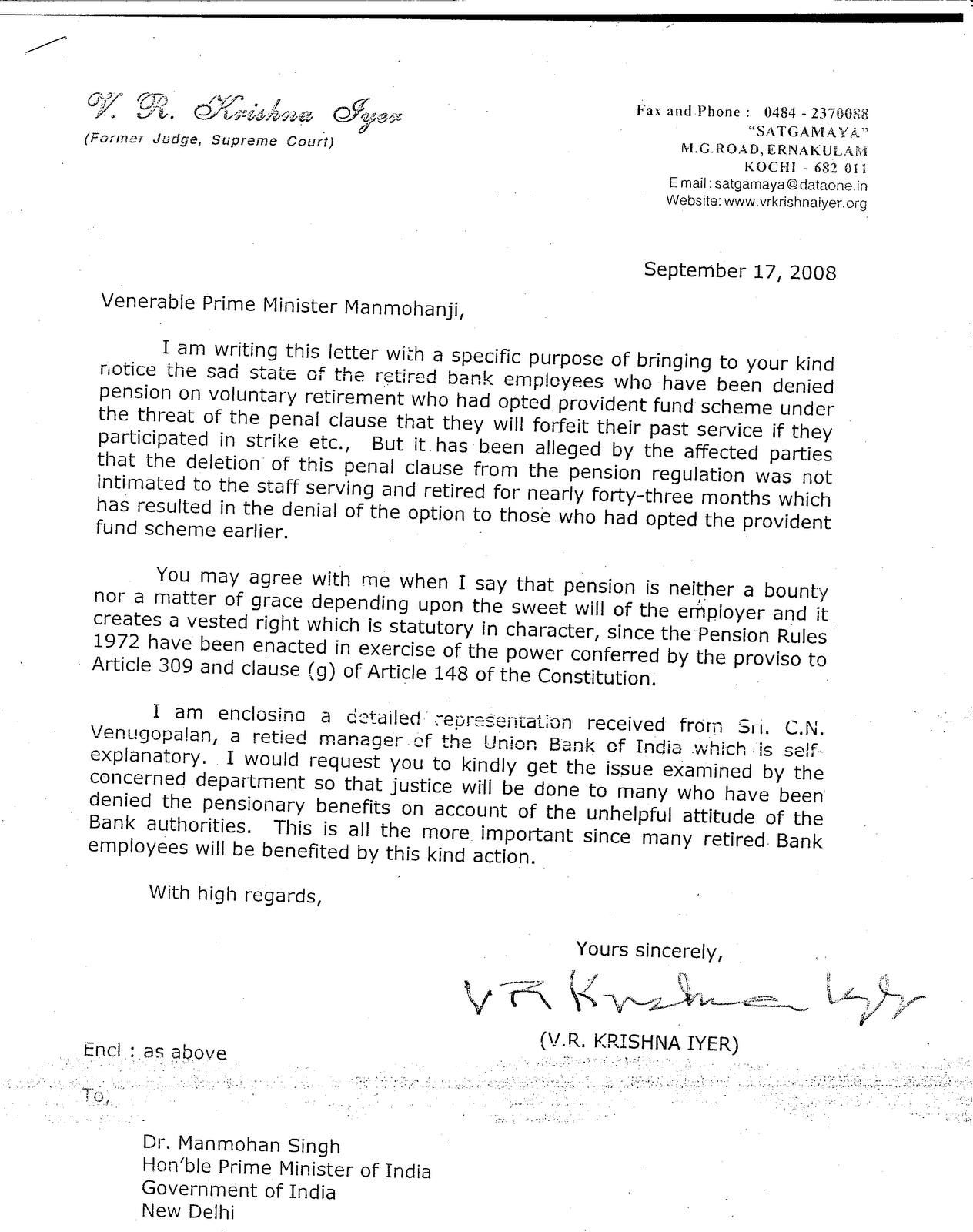

The UFBU secured Pension Option / IBA grants Fresh Option on Pension

“Union is Right, Union is might. Those who did not believe in Unions are in Plight”. It is a great accolade for the UFBU to have achieved a second option on Pension for those who could not opt for it earlier. Many leaders fought for it hard(ly) to see that the lost dream of the bank men is revived and made a reality. Those who blamed the work force who could not opt for it and wanted to see that they never get a fresh chance to opt as also those who categorically declared that CPF was beneficial to the employee are now competing with each other to establish that they fought and won it and are blowing their own trumpets. Will they please clarify:

• Was Pension not an already granted benefit?

• Why did Unions not secure a fresh to those who could not opt for it because of the infusion of the penal clause providing for forfeiture of entire past service in the Final Pension Regulations when the particular clause was deleted from it on 27th February, 2009 through a gazette notification?

• Did any Union or Director representing Workmen or Officers lodge any protest when banks took deviation from the normal procedure of internally issuing a circular about amendment to Service / Pension Regulations (with a statement that it would have effect from the date it is published in gazette) and confined to mere gazette notification for deletion of the penal clause?

• Did the amendment not carry with it an obligation on the part of banks to extend a fresh option? And if so why the issue was not taken up by any one responsible?

• Did any Union or Director know that banks circulated the amendment internally after a period of 43 months? Does the circular not prove that banks were aware of the need for circulating it among the employees and deliberately made a default earlier intentionally? Or did they circulate it belatedly as a measure of time pass?

• Was not a fresh option legally mandatory along with the amendment to Regulation? If so, was Pension not an already vested benefit which the banks unlawfully detained making the work force gullible?

• Why did Pension Option afresh vanish from the charter of demands of different Unions during the period from 2001 to 2006?

• How and why did Unions agree with the IBA during the course of 8th Bipartite Settlement that the item Pension Option would not be opened again?

• How and why did the two schools of thought (one objecting fresh option and the other sticking to the stand that CPF was still beneficial) took somersault from their old barracks and started fighting for fresh option?

• When the Government sanctioned and Board adopted Pension Regulations stated unambiguously that the option once exercised shall be final and irrevocable and the Regulations did not contain a provision for revocation of an exercised option, how did banks revoke the options of some employees at the behest of IBA? Was the revocation legal? Did Unions / Directors not know anything about this?

• Why did UFBU not insist on IBA to conclude the Pension Option issue within the time frame of 3 months as per the MOU dated 25th February, 2008 and caused another 18 months to lapse?

• Even on reaching a second MOU on 7th August, 2009 to give 17.5 percent wage hike and Pension Option why did it did not fruitfully meet the IBA to finalise things until 27th November, 2009? Was UFBU waiting for an auspicious day (the anniversary of a leader) for signing the pact to commemorate the event?

• Have all banks contributed 10 percent of the pay of each employee who joined the Pension Scheme to the Pension Fund of the respective banks as envisaged by the Pension Regulations Chapter relating to the composition of Fund?

• Was there not a provision for contributing a portion of the pay hike to the Pension Fund in the earlier bipartite settlements? Or is it the first time that the contribution formula (70:30) is evolved?

• When a segment of employees including those under VRS are paid full Pension including that on the notional service of 5 years ( which was denied illegally and released as per SC order) will it not tantamount to discrimination when the 70:30 formula is implemented for sharing of Pension burden? Will it not precipitate matters further?

• The Incremental profits of 17 listed Public Sector Banks over March 2006 level was to the tune of Rs.22,502.30 Crores during the ensuing three years . What was the difficulty of the banking system for pleading paucity of funds for meeting the Pension Burden and asking the employees to share the burden of Rs.1 , 200 Crores?

• During 2002 -2006 period public sector banks standing under the common umbrella of IBA were fighting with and pulling the legs of each other for take over of loans from counterparts for mere cosmetics of the key men employing the lethal weapon of interest rates taking advantage of the deregulated interest regime. Interest concessions were extended to potential borrowers while no benefits were given to the deserving. Life blood of banks oozed out in big proportions and banks got debilitated. Unwanted work load of processing the proposals of an avoidable nature was the only benefit to the banks. The vehement criticisms I leveled against those concerned when they extravagantly wasted money in the context of their lame extenuation to extend fresh option on Pension brought an end to the “take over mania” in the latter half of 2006-2007. If I state that my work resulted in making the banking system robust and make profits of a progressive nature from March, 2007, it would be calling a spade a spade only.

• Will the Unions that collected subscription from members throughout their service period cease to have any responsibility towards them when they retire? Are Unions not having any responsibility in respect of implementation of the agreements relating to the post retirement benefits? Were the Unions justified in not helping the retired in getting the terminal benefits correctly and in driving them to the various courts in quest of justice?

It is my earnest desire to give a clap to UFBU on the laudable achievement of Pension Option to the work force and hence I earnestly request any one of you to please clarify on the above points.

Thanks and Regards

C N Venugopalan

According to statistics submitted by the finance ministry before Parliament on Friday, the government banks together in the last three years, since 2007, have written off nearly Rs 25,000 crore. -- Times of India - This could be done splendidly No money to meet establishment expenditure for the bankrupt bankers

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment