Business Daily from THE HINDU group of publications

Monday, Sep 08, 2008

ePaper | Mobile/PDA Version | Audio

Perspective

Opinion - Social Security

Money & Banking - Pension Plans

Banking on consensus

C. N. Venugopalan

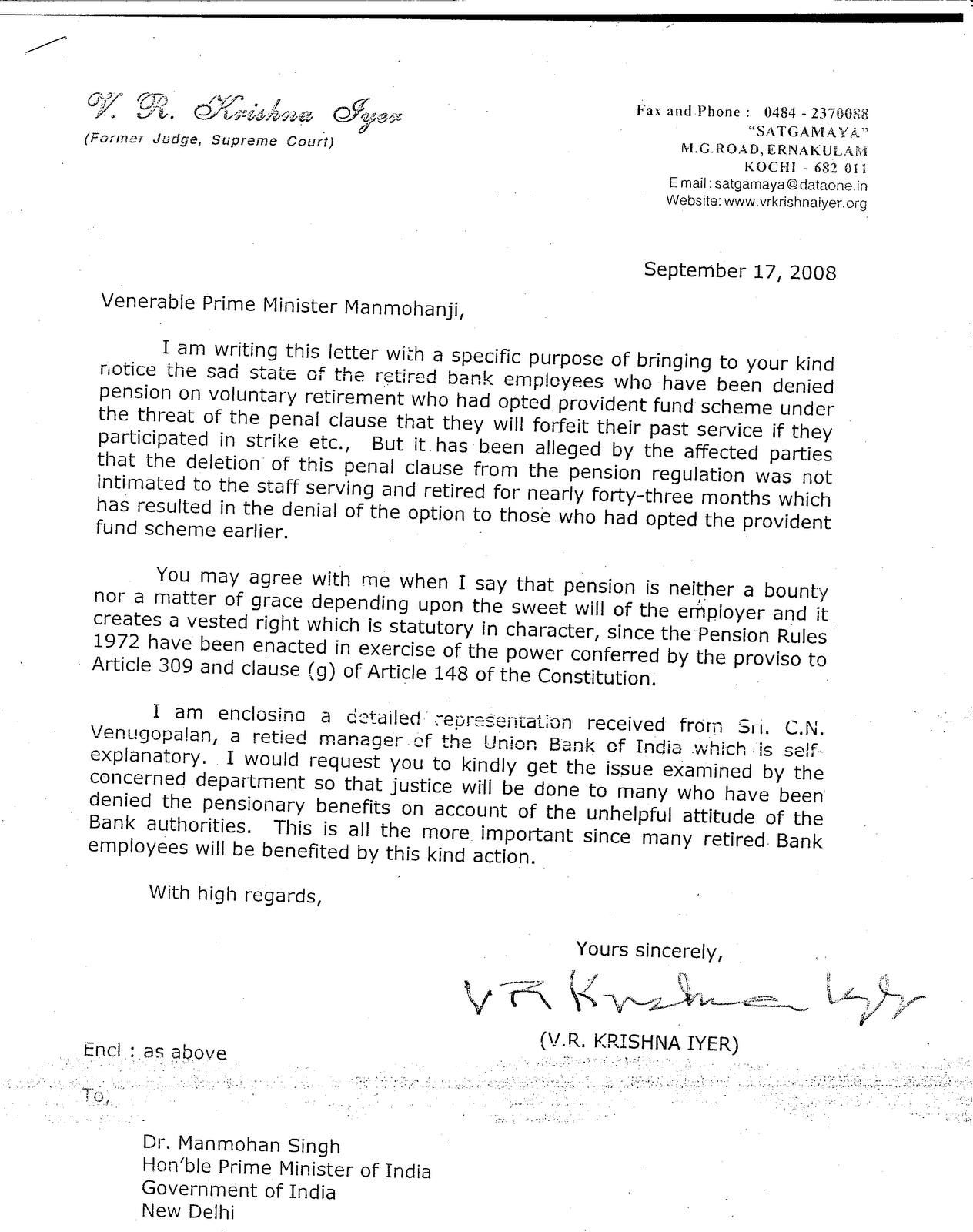

The pension scheme in banks does not cover about 70 per cent of the employees working in the industry. The understanding between the Indian Banks’ Association (IBA) and bank unions in March 2008 to finalise extension of fresh option for pension within three months is yet to be implemented.

Based on the pension scheme for Central Government employees, pension was introduced in banks in 1995. The scheme extended coverage to all those who retired from banks on January 1, 1986, by taking back from them the contributory PF (employer’s share) paid to them at the time of retirement, together with 6 per cent interest.

It further extended compulsory coverage to those recruited after the commissioning of the scheme without any contribution from them to the Pension Fund. It remains ironical that the majority of employees who were in service at the time of inception of the scheme are denied the benefit.

The pension scheme contained a provision vesting banks with the right to forfeit the entire past service of an employee if he participated in a strike. The final regulations also called afresh for an option to be exercised before a further date in case of those who did not opt earlier.

Consequent on trade union pressure, banks later deleted the forfeiture clause in February 1999, but did not extend a fresh option to the employees in the wake of the amendment, to those who revoked their options or did not join the scheme on account of the deleted harsh clause. Banks confined the amendment to mere gazette publication, keeping it in camera. Trade unions that got the clause removed from the regulations failed to secure for members a second chance to exercise an option to which they were legally entitled when the offer terms changed.

Not legally maintainable

After publishing the final regulations, banks gave employees a chance to revoke the options exercised in response to the draft regulations upon advice from the IBA. The regulations had categorically stated that an “option once exercised shall be final and irrevocable” and nowhere contained a provision for revocation of an exercised option.

Since the IBA has no powers exceeding that of the board of banks or the Central Government that sanctioned the scheme, the revocation done at its behest is not legally maintainable. Paucity of funds to meet additional financial burden is claimed as a reason for not extending fresh option. The question that pops up is “what would banks have done if all had opted for it when offered?”

Granting a second option for pension with retrospective effect to all those on the rolls in February 1999 is mere compliance with the requirements of law and not an extension of a fresh benefit. Banks, Government and trade unions should reach a consensus on the issue and settle it expeditiously to render justice to employees, retired and working, who have the prescribed qualifying service.

(The author is Vice-President, Union Bank of India Retired Officers’ Association — Kerala.)

More Stories on : Social Security | Pension Plans

Article E-Mail :: Comment :: Syndication :: Printer Friendly Page

________________________________________

The Hindu Group: Home | About Us | Copyright | Archives | Contacts | Subscription

Group Sites: The Hindu | The Hindu ePaper | Business Line | Business Line ePaper | Sportstar | Frontline | The Hindu eBooks |

Subscribe to:

Post Comments (Atom)

2 comments:

Sincere efforts of Venugoplan has yielded results today. Kudos to Venu for his untiring effort to achieve the goal. Let us always work for others which gives immense pleasure.

thanks to sh. venugopalan for hid hill like effort which forced the bankers to open atleast option for pension including retirees.

he should not sit keep quite. send your E mail Id on my ID asokgoel1947@gmail.com

I salute u once again.

Post a Comment