Friday, September 26, 2008

Thursday, September 25, 2008

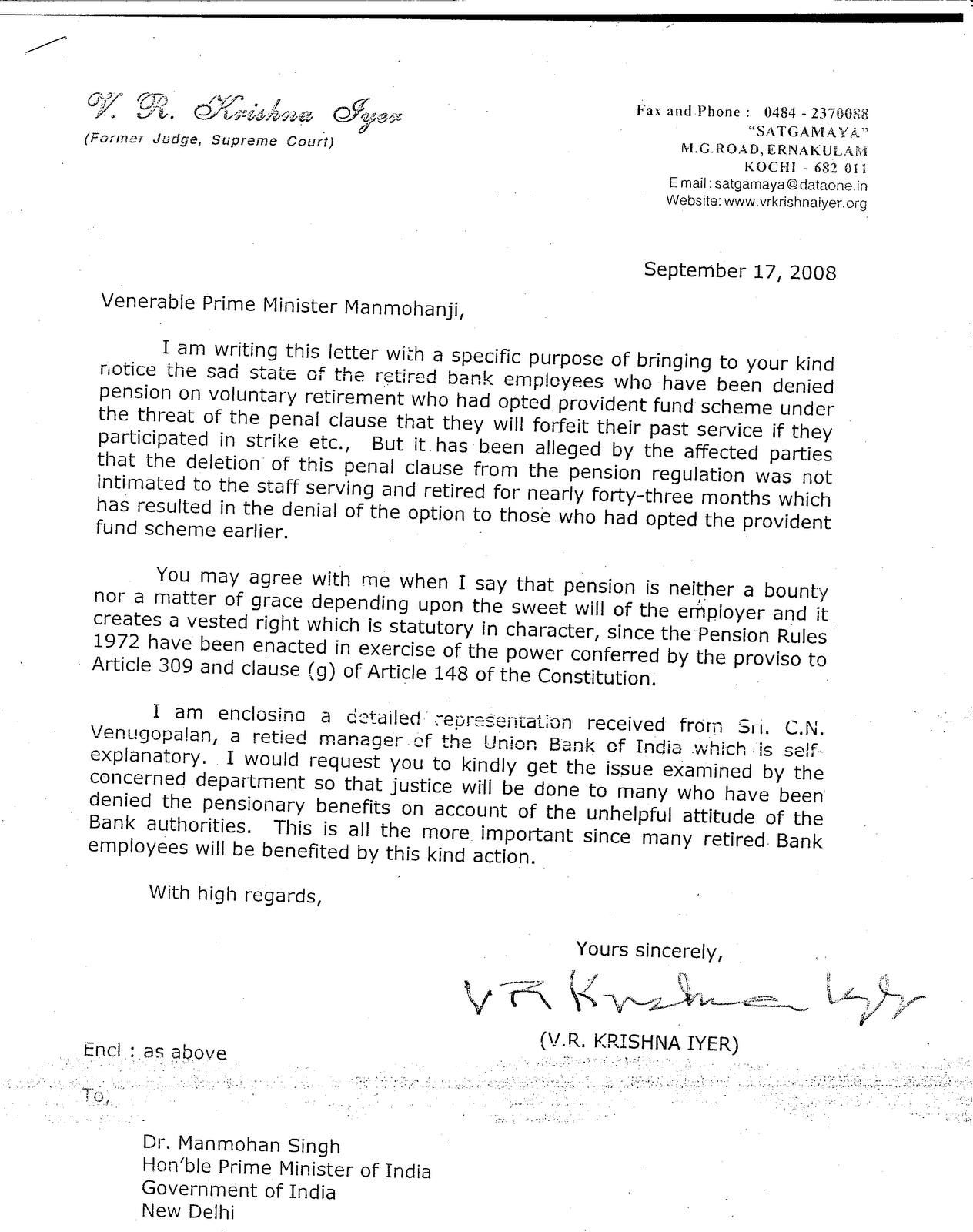

Letter to Prime Minister ( Recommended by Former Judge of Supreme Court

C N Venugopalan

Ex-Manager, Union Bank of India &

Vice President UBI Retired officers’ Association (Kerala)

Nandanam

Kesari Junction,

N Parvoor,

Kerala – 683 513

Phone. 0484 2447994 Mob: 9447747994 E-Mail: ceeyenvee@gmail.com

No. 20080916 16th September, 2008

Hon’ble Prime Minister of India,

Office of the Prime Minister,

Government of India,

Parliament Street,

New Delhi – 110 001

Respected Sir,

Denial of pension to majority of bank employees including me –

I was working as Officer MMJS-II in Union Bank of India with employee No. 028506 and I retired through Voluntary Retirement Scheme, 2001 on 20th April, 2001 after putting in 30 years of service in the Bank sans Pension benefit.

I had appraised you the injustice the Banking Industry meted out by denying Pension to a number of retired employees like me vide my letter dated 10th January, 2007. I regret to note that although your office was kind enough to forward my letter to the Secretary, Financial Sector, Ministry of Finance vide letter. PMO No ID No. 09/ 3 / 2007-PMP-4/750170 dated 22-JAN-2007, it received scant attention and no outcome has arisen. Whereas pension is not a new benefit to be given but is a benefit already granted by the Government in 1995 to employees, the denial of the benefit has arisen only through the wrong, illegal and whimsical implementation of the scheme.

Pension scheme on the lines available to central government employees was sanctioned in Banks in 1995. CPF scheme simultaneously continued for making available the existing benefit to those who could not secure prescribed minimum service of 20 years. Majority of employees are outside Pension Scheme now as a result of faulty and unlawful implementation of the scheme. Draft Pension Regulations published as also the final Regulations sanctioned by the Central Government called for options to be exercised within a prescribed date. When Final Regulations, contained a harsh clause enabling banks to forfeit the entire past services of an employee for participation in strike, (in variance from the draft regulations), many who opted earlier wished to come out and others who had not opted in terms of the draft did not join for fear of losing CPF and Pension if bank forfeited past service. Later, when the harsh clause was deleted from the Regulations on 27th February, 1999 following trade union pressure, options of those who took exit were not reinstated and others who had not opted on account of its infusion in final Regulations were not given fresh option. The amendment without specifying any effective date has effect from the inception of the scheme and the variation in offer terms vested with all a right to fresh option. Yet banks flouted fundamental principles of law and natural justice and did not give fresh chance of option. Banks thus meted out gross injustice to majority of bank men by denying Pension, the only source of income on cessation of employment and a right akin to fundamental rights of an employee.

Banks that usually circulated all amendments for information of employees before publishing in gazette kept the particular amendment in dark for enormously long time of 43 months and afterwards circulated it in a casual and stealthy way without taking individual acknowledgement as per practice in force. In Union Bank of India, the amendment of 27th February,1999 was published only on 8th October, 2002, after a time gap of 43 months. Many who retired in the meantime especially though VRS in April, 2001 had no information at all about it.

The scheme Government sanctioned contained no provision for revocation of an exercised option and had categorically stated that “an option, once exercised shall be final and irrevocable”. Yet, upon an advice from Indian Banks Association, (IBA) banks extended a chance and revoked options exercised in terms of the draft Regulations. IBA, a mere body of the bankers intercepted the authority of the Central Government by revoking the options exercised by the employees that were final in character. The revocation has taken place at the behest of IBA without taking previous sanction of the Government and without the Boards of Banks amending the regulations suitably. The process is null and void as IBA can not supersede the Central Government and / or the Board of the bank that adopted the Regulations. Even assuming that the process of revocation was a valid one, it has taken place when the harsh clause for forfeiture of entire past service was infused in the final regulations and the options had to be reinstated when the particular clause was deleted.

In short, those who had revoked their options and those who did not opt for the scheme when the harsh clause was inducted are having a legal right to get fresh option. Now it is strange that the Government is conducting feasibility studies for extending Pension Option as if it is a new benefit to be sanctioned. By not granting it in the original form to all those who have prescribed qualifying service, the Government and Banks are evading their own commitment to the employees and forcing them to agitate over the issue that is nearly a decade old one now.

The regulations did not have provision to pay pension before attaining the age of 60 and to employees with less than 20 years of service. However, Banks paid pension to such category that retired through VRS without enabling provisions. To escape accountability of unauthorized erroneous payments regulation 28 was amended on 13th July, 2002, reducing the qualifying service from 20 years to 15 years and vesting pension in premature retirement cases. This beneficial amendment too created an obligation for extension of fresh option especially to those who did not opt earlier.

Pension Scheme that took in its orbit all those who retired 9 years back from its inception by taking back the CPF paid on retirement and compulsorily encompassed all future recruits without any contribution from their side ironically denied the benefit to majority who were on the rolls at the time of inception of the scheme in 1995. Banks, whose profits contribute to the exchequer and partly meets the pension of government employees and statesmen, deny the benefit to their own employees by implementing pension scheme in a wrong way, flouting principles of law and natural justice.

Bank offices all over the country remained shut for three days during the last two years causing inconvenience to the public since Banks and IBA, drove the work force out of their seats on the issue of Pension Option. Another call for strike on September 24 & 25 is given by United Forum of bank Unions since the memorandum of understanding to resolve the issue within three months also is breached. Banking system is likely to get paralyzed once again. The blind trespass of bureaucracy into the pastures of simple and natural justice makes one feel that independence is a mirage even in the seventh decade of freedom.

I earnestly request you to intervene in the matter expeditiously and to direct the Ministry of Finance to examine details in the true perspective for rendering justice to all retired employees who are left in the lurch now by granting them the benefit of pension through proper implementation of the scheme in operation.

Thanking You,

Yours faithfully,

C N Venugopalan

Letter to T S NArayana Swamy, Chairman of IBA

C N Venugopalan

Ex- Manager, Union Bank of India

& Vice President, UBI Retired Officers’ Association (Kerala)

“Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994

Shri. T S Narayana Swamy, 3rd July, 2008

Chairman,

Indian Banks’ Association,

Block No. 2 & 3,

6th Floor, Stadium House,

81-83, V N Road,

Mumbai – 400 020

Respected Sir,

Congratulations!

I am delighted to hear that you have been enthroned as the Chairman of the Indian Banks Association vesting with you good opportunity to make it a meaningful organization that will meet its laudable objectives. Whereas it has lost its relevance as a progressive body, the task of resurrecting its eroded fundamentals is a formidable one. But I am sure your deft hands will find it an easy task to restore it glory by correcting past sins. Being an ex Unionite, it is my pleasure and duty to wish you all success and glory in the new assignment of making IBA a vibrant organisation.

In Union Bank, I succeeded Shri. P G Prasannakumar, Branch Manager at Vandiperyar in Idukki District controlled by Thiruvananthapuram Region you looked after in Kerala. After working in about seven branches as Branch Manager, I retired through "V R S" at the age of 50. Probably, you may not remember my name since I was a silent member in the family.

Past sins of IBA include several things that do not conform to any logical standards. Members of IBA had been quite unethical in business matters. Standing under the common umbrella of IBA, member banks were

pulling the legs of one other and snatching away the business of their own counterparts, using the lethal weapon of "interest rates" debilitating the banking system. Even the public sector banks themselves competed with each other and brought about serious financial loss to banking system in the scenario of deregulated interest rates. Take-over mania swept the banking system during 2004-2006 draining the profits and profitability. The resultant Loss was immeasurable. Reserve Bank of India remained to be Reverse Bank of India with no role in it. The beneficiaries of the foul game were potent people while deserving poor did not get any. Vehement criticisms I leveled against the unhealthy competition aimed at cheap cosmetics of the key men, put an end to take- over mania by August, 2006 and banks started posing excellent working results since the latter half of 2006-2007. About 10 to 20 percent of the interest income of the banks in India can reasonably be attributed to my work done, remaining outside of the banking system

It was ironical that banks that could afford such big loss of a heavy magnitude, banks that can bear the brunt of write-off to defaulters in the name of agricultural debt relief for pleasing the political masters, banks that can spend thousands of crores for changing a logo plead paucity of funds to pay pension to those who toiled for years together to make Banks what they are now. They have been adopting mean methods to avoid the legitimate dues of the work force in the industry. At the same time, the profits banks make, go to pay pension to government servants and to politicians who serve terms of 2 years and above in Parliament or Assembly. Banks chose to feed the neighbor's baby, putting their own babies to starvation. Banks compelled the employees to exercise option for pension, keeping in the

Regulations a clause enabling forfeiture of entire past service for participation in strike. On deletion of the clause on 27th February, 1999, they illegally acted and did not extend a fresh chance of option and moreover kept the amendment in camera by not circulating the amendment and by confining it to gazette publication. The regulations – draft and final- stated that option once exercised is final and irrevocable. Finally, they stated that IBA advised them to extend a chance for revocation of option exercised by an employee for any reason. They revoked the options at the behest of IBA when the Pension Regulations that were formulated in consultation with RBI and carried the previous sanction of the Central Government never had a provision for revocation of the options, which were final and irrevocable in nature. The process of revocation contemplated is illegal and founded on utter foolishness.

IBA has all along been taking double standard in the matter of compensating SBI staff and the rest of the bank employees by signing separate wage pacts for the two categories. In the matter of terminal benefits also, SBI staff have three benefits viz. PF, Gratuity and Pension as against Gratuity and / or PF in other banks. These are acts opposed to principles of equity and equality enshrined in the Constitution of India. Now that you have taken charge as Chairman of IBA, I implore that the illogical things looming large in the scenario may be eradicated to set IBA on a firm footing and to make the organization worthy of its name. As the talks on extending second option on Pension are reaching a final stage, I sincerely desire that you will use your wisdom and with your humane nature set right all anomalies and deliver justice to the entire banking community. I am eagerly watching to see the swift transformation of IBA under your eminent leadership from a bedlam into a responsible organization committed to the welfare of the bank men also while targeting higher goals of uplifting the entire nation.

With all good wishes and best regards, I remain.

Yours sincerely,

C N Venugopalan

Ex- Manager, Union Bank of India

& Vice President, UBI Retired Officers’ Association (Kerala)

“Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994

Shri. T S Narayana Swamy, 3rd July, 2008

Chairman,

Indian Banks’ Association,

Block No. 2 & 3,

6th Floor, Stadium House,

81-83, V N Road,

Mumbai – 400 020

Respected Sir,

Congratulations!

I am delighted to hear that you have been enthroned as the Chairman of the Indian Banks Association vesting with you good opportunity to make it a meaningful organization that will meet its laudable objectives. Whereas it has lost its relevance as a progressive body, the task of resurrecting its eroded fundamentals is a formidable one. But I am sure your deft hands will find it an easy task to restore it glory by correcting past sins. Being an ex Unionite, it is my pleasure and duty to wish you all success and glory in the new assignment of making IBA a vibrant organisation.

In Union Bank, I succeeded Shri. P G Prasannakumar, Branch Manager at Vandiperyar in Idukki District controlled by Thiruvananthapuram Region you looked after in Kerala. After working in about seven branches as Branch Manager, I retired through "V R S" at the age of 50. Probably, you may not remember my name since I was a silent member in the family.

Past sins of IBA include several things that do not conform to any logical standards. Members of IBA had been quite unethical in business matters. Standing under the common umbrella of IBA, member banks were

pulling the legs of one other and snatching away the business of their own counterparts, using the lethal weapon of "interest rates" debilitating the banking system. Even the public sector banks themselves competed with each other and brought about serious financial loss to banking system in the scenario of deregulated interest rates. Take-over mania swept the banking system during 2004-2006 draining the profits and profitability. The resultant Loss was immeasurable. Reserve Bank of India remained to be Reverse Bank of India with no role in it. The beneficiaries of the foul game were potent people while deserving poor did not get any. Vehement criticisms I leveled against the unhealthy competition aimed at cheap cosmetics of the key men, put an end to take- over mania by August, 2006 and banks started posing excellent working results since the latter half of 2006-2007. About 10 to 20 percent of the interest income of the banks in India can reasonably be attributed to my work done, remaining outside of the banking system

It was ironical that banks that could afford such big loss of a heavy magnitude, banks that can bear the brunt of write-off to defaulters in the name of agricultural debt relief for pleasing the political masters, banks that can spend thousands of crores for changing a logo plead paucity of funds to pay pension to those who toiled for years together to make Banks what they are now. They have been adopting mean methods to avoid the legitimate dues of the work force in the industry. At the same time, the profits banks make, go to pay pension to government servants and to politicians who serve terms of 2 years and above in Parliament or Assembly. Banks chose to feed the neighbor's baby, putting their own babies to starvation. Banks compelled the employees to exercise option for pension, keeping in the

Regulations a clause enabling forfeiture of entire past service for participation in strike. On deletion of the clause on 27th February, 1999, they illegally acted and did not extend a fresh chance of option and moreover kept the amendment in camera by not circulating the amendment and by confining it to gazette publication. The regulations – draft and final- stated that option once exercised is final and irrevocable. Finally, they stated that IBA advised them to extend a chance for revocation of option exercised by an employee for any reason. They revoked the options at the behest of IBA when the Pension Regulations that were formulated in consultation with RBI and carried the previous sanction of the Central Government never had a provision for revocation of the options, which were final and irrevocable in nature. The process of revocation contemplated is illegal and founded on utter foolishness.

IBA has all along been taking double standard in the matter of compensating SBI staff and the rest of the bank employees by signing separate wage pacts for the two categories. In the matter of terminal benefits also, SBI staff have three benefits viz. PF, Gratuity and Pension as against Gratuity and / or PF in other banks. These are acts opposed to principles of equity and equality enshrined in the Constitution of India. Now that you have taken charge as Chairman of IBA, I implore that the illogical things looming large in the scenario may be eradicated to set IBA on a firm footing and to make the organization worthy of its name. As the talks on extending second option on Pension are reaching a final stage, I sincerely desire that you will use your wisdom and with your humane nature set right all anomalies and deliver justice to the entire banking community. I am eagerly watching to see the swift transformation of IBA under your eminent leadership from a bedlam into a responsible organization committed to the welfare of the bank men also while targeting higher goals of uplifting the entire nation.

With all good wishes and best regards, I remain.

Yours sincerely,

C N Venugopalan

ACTUARIAL EXERCISE ON PENSION

C N Venugopalan

Ex- Manager, Union Bank of India &

Vice President, Union Bank of India Retired Officers’ Association (Kerala)

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994 e-mail: ceeyenvee@gmail.com

Shri. M B N Rao, 26th April, 2008

Chairman,

Indian Banks Association, For kind personal attention

Mumbai,

Dear Shri. Rao,

Actuarial exercise on Pension

Children, smelling defeat while playing, resort to playing foul, violating all ground rules to spoil the entire game. Among the elderly, scoundrels playing the game of cards insert fake cards and win the game without the opponent seeing the mischief. If at all found out, they use muscle power and run away with the bet money. The banking dignitaries are not far from such people and act sans dignity while dealing with pension related issues. They ignore or violate cardinal rules and ethics, play foul and take shelter under power of purse and authority. They break the Regulations which they themselves made and behave like people sans self respect.

I am sorry to note that you have not cared to respond to any of my letters sent to you in your capacity as the Chairman of IBA and also personally for the simple reason that you do not have any justification to offer in respect of the absurdities and mistakes the IBA has committed while implementing schemes like VRS and while paying unauthorized pension to several people - it paid superannuation pension payable on attaining the age of 60 much before that to VRS retirees without Pension Regulations containing an enabling provision and subsequently amended Regulation 28 with retrospective effect to escape the accountability of wrong payment - and at the same time refusing Pension to several others who have the qualifying period of service to be eligible for pension and are legally entitled to it .

The IBA is again attempting to engender fresh issues that will precipitate while going on examining feasibility of extending second option on Pension with reduced benefits than what is extended originally. Fresh actuarial valuation is insignificant altogether since all those in service of the banks in 1995 are entitled to fresh option in the wake of the February, 1999 amendment to Regulations. Banks at that time, torpedoed all legal principles, kept the target group uninformed by publishing it in the gazette alone, contravening the usual practice of circulating in English and Hindi through appropriate internal communication.

Likewise, while reckoning the qualifying service, the grace period of five years to be added to actual number of years of service as provided in the Pension Regulations was not allowed to VRS retirees in several banks though the terms of offer of VRS originally stated that Pension would be payable as per Pension regulations to those retiring through it. The offer was amended at the fag end of the offer period of VRS without giving an opportunity to the subscribers to withdraw subscription to VRS.

In Union Bank, during the Leeladhar Regime, the gratuity was paid in two instalments to VRS retirees. It was not the first time employees were retiring from the Bank so as to get the payment vitiated by a mistake. On bringing the matter to his notice, the Chief Executive embraced stupendous stupidity driving the employees to external agencies for corrigendum action. Ultimate result proved that the Bank had defrauded and consumed the sweat of the brows of those who had partnered with it in its growth. The amount was to the tune of Rs.600 Crores which the Bank embezzled from its own people who went out co-operating with the management that wanted to trim its size. Such illustrious deeds elevated its architect to the present position and provide inspiration and motivation to career oriented people to follow suit for achieving their goals.

The mischievous acts the dignitaries in the elite banking circles have committed would take to shame even scoundrels. Recently there was a press report about the Chairman of a PSB, upon reading an earlier report of an auto driver returning to the owner the articles he had forgotten in his cab, relaxing the margin norms and granting an auto rickshaw loan. If the auto driver comes to know that the banker is one who has deceived his own people who worked for the bank by not granting them their eligible pension, he would perhaps refuse the gift altogether.

The comforts they enjoy while staying in star hotels most often and elite living conditions must have made the bank executives forget the past entirely and think that others are also comfortable. Ageing does not bring in wisdom but contracts cataract to impair their vision instead of broadening it. An attempt to step into the shoes of a person who is denied his legitimate pension, which is the only means of living at the fag end of his life, may open the vistas of mind.

Instead of carrying out the legal obligation to extend fresh Pension option in the original form it was extended earlier. IBA is now conducting an actuarial exercise. In order that such an exercise shall be meaningful to some extent at least, in respect of those who are already in Pension stream, banks should contribute to the pension Fund an amount equivalent to what is held in the employee’s share of compulsory PF minus what has been transferred into the Pension Fund earlier, in 1995. In respect of those who retired already, the contributions till date of retirement minus what is transferred initially should be transferred. The Pension Funds will definitely have surplus after meeting all Pension obligations as the compulsory employees’ contribution to PF of all the fresh entrants to Pension will also augment the Pension Funds of banks significantly for meeting all pension obligations with ease and comfort..

Banks and IBA appear as not led by logic or reason and find money to squander in so many ways. They take the command of the political masters and stand in a line as obedient dogs for getting favours. Interest free loans to sugar sector and waiver of agricultural loans for poll prospects meet with their approval when they plead paucity of funds for basic items like Pension. The bankers who stand below the common umbrella of IBA pulled legs of each other for snatching away the business of counterparts, using the dreaded weapon of reduced interest rate debilitating the individual banks. Vital fluid of banks oozed out in thousands of kilo litres enfeebling the entire banking system. The vehement criticisms I put forth put an end to the brisk interest war in the latter half of 2006-2007. Ten to twenty percent of interest income banks generate now can reasonably be attributed as my contribution made to the banking system remaining outside it and without being remunerated and the key men who have been enjoying fat remuneration were dwindling the resources for their cosmetics of business promotion. It is only after making fantastic contributions and after strengthening the system that I am pleading for justice to grant me my Pension, a legitimate due, which is not a charity doled out to a retired employee at the sweet will of the employer.

What I appeal to you is that:

Decisions should be dictated by what’s right and not by what it might cost us to do what’s right. Don’t let mistakes and failings take you prisoner. Ask God for fresh inspiration and wings of faith to help you rise above them.

We are all dignified people who call as “father” the person who engendered us. It is our benign responsibility to honour all commits we made. Let our deeds reflect our quality. We are people who enforce substantive law with full vigor against bank defaulters. Let us not be defaulters before the same law that enables us to perform our roles. Let us correct all past mistakes that have come to our notice and not stick on to them on grounds that are not tenable. Let bankers not be cowards and moral bankrupts for doing the right. I B A should strive to be worthy of being called Indian Banks Association to protect the interest of the bankers lest fellow bankers may think in terms of calling it “Indian Bastards Association”. If you imagine yourself in my place for a while, you will be able to easily grasp my strong feelings in the matter and I am sure you will initiate swift befitting corrigendum action. Let us not attempt to patch holes with darkness. Let us grant Pension option with retrospective effect to all those who have the prescribed qualifying service (including the notional grace period) and strictly as per our own Pension Regulations. Let qualifying service be the criterion and not the mode of exit, especially when the latter is formulated by the bankers themselves for their advantage. Let us not waste time as time is precious and important.

Thanking You,

Yours faithfully,

C N Venugopalan

M B N RAO Chairman IBA- Second Letter

C N Venugopalan

Ex- Manager, Union Bank of India

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994

PEN IBA :124

31st October, 2007

The Chairman,

Indian Banks Association,

For Personal Attention of Shri M B N Rao

Mumbai

Dear Sir,

This has reference to my letter dated 14th September, 2007 captioned “Be on terra firma, Bankers” I sent to you, the reply of which is still awaited. It appears that you have nothing to contradict on any of the observations I made in it pervasively on the pension related issues in Banks. Banks still have to cultivate a good and rich tradition of establishing fairness in all areas of operation and to set a model before other segments of business and industry in tandem with the rich tradition of the country.

I have to be a spokesman of the retired people more than of those now working and hence I stress the need for extending Pension benefit to all who have gone out through VRS and other schemes. When one section that went out through VRS is getting Pension, the left out people who have made the same contribution to the industry ought to be treated on par. It is not the modus of exit, but the qualifying service stipulated as per the Pension Regulations that matters. Any corrigendum action without containing the element of jurisprudence to the full extent will be a lame action that will perpetuate injustice again.

It appears that the industry is seized of the need for extending a second option by extending the scheme in its original form to those who did not exercise the option on account of the existence of the deleted clause (relating to forfeiture of past service for participation in strike). If so there is no point in dilly-dallying the matter by examining the actuarial aspects. Banks will become richer, morally and financially as can be judged from the fantastic working results, individual units are making now. As I said earlier, implementation of the scheme will not cost anything more to the industry and the expenditure can be contained within the level of expenditure obtaining in 1995. What is required is only a positive approach to the issue.

I trust, the matter is amply clarified. I expect to hear from you a line in reply, in case you do not concur fully with any of my observations.

Thanking You,

Yours faithfully,

C N Venugopalan

Ex- Manager, Union Bank of India

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994

PEN IBA :124

31st October, 2007

The Chairman,

Indian Banks Association,

For Personal Attention of Shri M B N Rao

Mumbai

Dear Sir,

This has reference to my letter dated 14th September, 2007 captioned “Be on terra firma, Bankers” I sent to you, the reply of which is still awaited. It appears that you have nothing to contradict on any of the observations I made in it pervasively on the pension related issues in Banks. Banks still have to cultivate a good and rich tradition of establishing fairness in all areas of operation and to set a model before other segments of business and industry in tandem with the rich tradition of the country.

I have to be a spokesman of the retired people more than of those now working and hence I stress the need for extending Pension benefit to all who have gone out through VRS and other schemes. When one section that went out through VRS is getting Pension, the left out people who have made the same contribution to the industry ought to be treated on par. It is not the modus of exit, but the qualifying service stipulated as per the Pension Regulations that matters. Any corrigendum action without containing the element of jurisprudence to the full extent will be a lame action that will perpetuate injustice again.

It appears that the industry is seized of the need for extending a second option by extending the scheme in its original form to those who did not exercise the option on account of the existence of the deleted clause (relating to forfeiture of past service for participation in strike). If so there is no point in dilly-dallying the matter by examining the actuarial aspects. Banks will become richer, morally and financially as can be judged from the fantastic working results, individual units are making now. As I said earlier, implementation of the scheme will not cost anything more to the industry and the expenditure can be contained within the level of expenditure obtaining in 1995. What is required is only a positive approach to the issue.

I trust, the matter is amply clarified. I expect to hear from you a line in reply, in case you do not concur fully with any of my observations.

Thanking You,

Yours faithfully,

C N Venugopalan

Letter to Shri. M B N Rao Chairman IBA

C N Venugopalan

Ex- Manager, Union Bank of India

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994

PEN IBA :123

14th September, 2007

The Chairman,

Indian Banks Association,

For Personal Attention of Shri M B N Rao

Mumbai

Dear Sir,

Be on terra firma, Bankers

I take the privilege of addressing to the Chairman of IBA, ‘house of intelligentsia of Indian Bankers’ that is committed to taking the Indian economy to heights day by day are taking the bank menfor ride. I introduce myself as an erstwhile minute particle of the vast ocean of banking, having voluntarily retired from a public sector bank, more precisely from Union Bank of India, with twice the qualifying service for Pension, yet devoid of it. Since you are heading IBA, the team of experts that claim to be a forward looking organization committed to the progress of the country, I take the privilege of placing before you certain puzzling and riddling facts for treating with your wisdom and for evolving befitting solutions with courage and righteousness without leaving your house as a bedlam.

My observation is that the rich Indian banks have morally turned bankrupt sans a positive mindset and pleads want of capacity for adequately compensating for work while they have ample money to recklessly squander. They imbibe the evils of bureaucracy in its worst form. Even as they derive their powers out of and owe their existence to substantive law of the nation, they utterly disregard all jurisprudence and the provisions of the law and of the Indian Constitution. They spend lavishly on travel, hotel bills, and cock tails accompanying business meetings and customer meets. Lack of integrity and foul play often surface at top levels. In spite of availability of solid securities, they free the loan defaulters extending OTS benefits and release securities for personal ends. The recent news in the air being the graft charge against former CMD and the Regional Head, Ernakulam of Vijaya Bank points to nothing else than corruption and lack of integrity at higher levels. The Chief Executives of Banks which shared ATMs for cost reduction, who are the members of the same house IBA pulled the legs of each other and spent lavishly for each one’s cosmetics in the name of business promotion. CASA is one powerful weapon in their hands to exploit the community to raise interest free and low cost funds without compensating the customers with whose money they flourish. And they beat them severely with exorbitant service charges extended to all possible areas.

The interest concessions given to the potential borrowers in the process of taking over accounts from counterparts made the Indian banking system lose its life blood immensely. Corrupt practices helped potential borrowers to obtain credit at astonishingly low rates. Clever bankers found it a way to get rid of bad accounts by issuing clean chits to defaulting borrowers and helped them take higher level of Credit limits from others banks. This was in full swing until August, 2006 when the Government gave some guidelines on this score. The extent of loss through interest reduction on loans and advances ran in several crores the volume of which is not known to anybody. Despite everything the industry has now become vibrant. Banks which were in the red earlier are posting bright and fantastic working results. Vehement criticisms I made in the second leg of 2006 put the foul games to an end to some extent when the government issued certain guidelines on “interest rate war”. About 10 to 15 percent of the interest income of the entire banking industry during the last year can reasonably be attributed to the efforts I made though everyone concerned will be reluctant to admit. It is my contribution to the entire industry which goes without acknowledgement. The BRA was amended by in August, 2006, changing the nomenclature of their directors on Board the different banks from “Working Directors” to “Nominee Directors” as a result of my criticism that RBI remained a silent spectator to everything. Since February, 2006, I had specifically pointed out to RBI and MOF about the disappearance of a PSB viz. New Bank of India form the banking galaxy despite close supervision and surveillance by the RBI with its directors on Board. When the catastrophe arose, RBI emerged out for saving its face by merging the entity with PNB and went back to pavilion. The entire problems that cropped up and the loss was absorbed by PNB. The queer scientific ways in which many a scheme was implemented in the industry have been quite elusive to me. It is my earnest belief that being the head of the body of bankers that formulates and implements innovative schemes, you are the apt and only person who can solve the riddles and puzzles that appear before me and to clarify the rationale behind the various actions.

In labour scenario, there had been two agitations – one of 27th July, 2006 and the other on 27th October 2006 - pressing the demand for Pension Option afresh in the industry. Another agitation programme scheduled from 28th March 2007 was stalled on the understanding that unions in the industry would submit a scheme before 30th April, 2007 and that a logical conclusion would be made before 30th June, 2007. In this context, what exactly was the reason for another strike in the industry on 12th September, 2007 which has also been stalled? When a Pension Scheme that prescribes the minimum qualifying service and other modalities is already in operation in banks, is there any justification in calling for and considering a fresh scheme. If a MOU had been there, who is at default and who has violated it? Whereas there is a legal onus of extending the existing Pension Scheme to all those having the prescribed qualifying service in the wake of the Feb.1999 amendment to Pension Regulations, what is the justification for wasting time on unnecessary meetings and discussions? It is high time that the motley crowd of experts from the management side and from trade unions enjoying a piggy ride on the back of the work force to stop the foul game and act on realities.

Those who clamour for fresh option are people who could not opt for it earlier when called upon to do so keeping the clause enabling managements to forfeit the entire past services for participation in strike even for a single day as it would deprive them of both PF and Pension after surrendering the CPF to Pension Fund. When Banks scrapped the clause through a Gazette Notification in February, 1999, they had a legal liability of extending a fresh option to such people. Banks, which used to issue internal circular both in English and Hindi, mentioning the details of the proposed amendment for the information of the target group mentioning that it would have effect from the date it is published in the Gazette kept the information in camera by confining to Gazette notification alone. A school boy as well as a legal luminary will not differ in concluding that banks acted malafide in doing so. The stand of the intelligent bankers who find justice in it is analogical to patching a hole with darkness. Once again, when the minimum qualifying service of 20 years for pension was reduced to 15 years in 2000, similar liability arose in the respect of those who did not opt for Pension for want of total service of 20 years ( past service and future service), but with total service of 15 years and more. Can you just explain the justification or rationale behind the action, if any, in not extending fresh option at this point of time for my information? Can it be called by any other name than “Cheating” one’s own folks who brought the banking system to what it is? The so called eminent bankers, when they end up their jobs to live peacefully, will carry with them Balance Sheets that containing imbalance alone. The liabilities in it will certainly overweigh assets or there will be no assets at all left on account of the prick of conscience for having deceived their own folks who worked for them.

The Pension Scheme commissioned in the year 1995 took under its purview all those who retired from 01 01 1986 and paid Pension to all those who had gone out some nine years back by taking back the PF amount paid to them along with a nominal interest. What is the relevance of the effective date 01 01 1986 and was it not to extend the benefit to a trade union leader who retired some time in 1986? If it can be extended to a trade union leader who spent most of his time in organizing the workmen rather than working for the bank, why can’t the benefit be given to those who are working at present and those who retired with the prescribed qualifying service after commissioning the scheme?

The Pension Scheme guarantees a Pension to all those who joined the Banks after its implementation without any sacrifice or contribution from their side to the Pension Fund in the form of surrender of the CPF. Is there any logic behind denying the benefit to those who have already put in service ranging from 30 to 35 years and who would surrender substantial sums lying to the credit of their PF for joining the Pension Scheme? Can it be called by any name other than absurdity of a Himalayan proportion?

Banking intelligentsia that has bureaucratic power and money power ratified several irrational actions to get rid of accountability arising out of all their mistakes. For instance superannuation pension was payable only on attaining the age of superannuation to an employee. But banks paid Pension to all those who took Voluntary Retirement from the ensuing month of exit without the Pension Regulations containing an enabling clause. Regulation 28 was subsequently amended on 13th July, 2002 as follows:

Provided that, with effect from 1st day of September, 2000, pension shall also be granted to an employee who opts to retire before attaining the age of superannuation , but after rendering service for a minimum period of 15 years in terms of any scheme that may be framed for such purpose by the Board with the approval of the Government.”

The said amendment made with retrospective effect, by itself, speaks for want of provision in the Regulations to pay the Pension from the ensuing month of retirement. VRS scheme had stated that those retiring will be paid Pension as per Pension Regulations i.e. from the date of normal super annuation, but banks paid them Pension much earlier contravening the Pension Regulations as well as the V R Scheme. Banks duped those who retired through VRS from the PF segment by depriving them of the PF contribution that was payable to them till the date of super annuation. Those in PF segment have also rendered the same contribution to the industry as that given by the Pension segment people. Can we term the discrimination as banking jurisprudence? Why is the generosity to one segment of people when both the categories have done the same work in all respects? Can you just imagine for a while, to be in the place of a person like me who has rendered ardent service for a period of thirty years, and yet devoid of Pension when the qualifying service to earn Pension in the industry is only 15 years ( just one half of the service I put in) as per the Regulations? The whole English language does not seem to have an apt word to describe the intensity of the hoodwinking involved.

People who embraced Voluntary Retirement are martyrs who made a further sacrifice by surrendering their future services when the banks wanted to trim their size for enhancing working results. They co-operated with the management and accepted a sacrifice which was capital forbearance to them. Is it the mode of exit or the service rendered that qualifies a person to Pension, which is considered as deferred wages akin to fundamental rights guaranteed by the Constitution? Or does the banking jurisprudence contain only wild justice that can deny Pension to subsequent retirees especially in the background of having took under its purview all the retirees with retrospective effect of nine years from 01 01 1986? Is it not quite ironical and strange?

It is pertinent to point out that after taking exit through VRS, a number of people have joined other banks and are working there. The former employer pays him salary for the left over services concurrently with Pension. They are also drawing salary from the Banking system simultaneously. What they need to take is just a permission from the former employer to work again, which is normally given by the Lords in the industry who profess themselves to be above the Supreme God. Is there any logic behind extension of triple benefits to one segment and denying everything to others?

The profits banks generate go to augment the exchequer of the country for paying Pension to the government staff whose work is not linked to any productivity. The politician, who sits for a term of two years either in Parliament or Assembly, despite being ousted on account of serious offences or public disapproval, too earns a pension. The daily bread of a retired bank man is snatched away keeping him to starve for feeding others who have not made any contribution to the industry. Banks are venturing out for the welfare of the world at large without setting right their own house first. Even pimps in the society would feel and mentally consoled elated for their work if they come to know that the bankers are acting in such a mean way.

Conversion or dealing in other’s money is recognized as taboo in banking sector. Banks however did it all along after 1995 by discontinuing all further PF contributions in respect of employees who joined Pension Scheme in 1995, after transfer of their PF balances into the Pension Corpus. Banks which had liability to contribute to CPF in respect of all the employees on the rolls till their retirement conveniently reduced their establishment expenses by discontinuing PF contribution in respect of those who joined the Pension Scheme. Similarly, in the case of fresh recruits after inception of Pension Scheme, the CPF payable was not worked out and transferred to Pension Corpus. Banks converted establishment expenses into profits and distributed as dividends, deceiving the entire work force for past 11 years. Conversion which is an illegal act is practiced and made the order of the day in banking scenario.

The material things to ponder upon are whether Pension is a consideration for a mere letter of option given or one for the relentless, long and efficient service rendered to the organization. The Apex Court has held that:

It is deferred wages and a payment of the compensation for services rendered.

It is not a bounty or a matter of grace depending upon the sweet will of the employer

It created a vested right which is statutory in character because Pension Rules are enacted in exercise of the powers conferred by proviso to Article 309 and clause (5) of article 148 of the Constitution

Pension is not an ex-gratia Payment but it is a payment for past services rendered

It is a social welfare measure rendering socio economic justice to those who in the hey day of their lives carelessly toiled for the employer on an assurance that in their old age they would not be left in the lurch.

The IBA that claims to be a scientific body that aims to bring about progress of the economy has all along been a party to discrimination. It created among the bank men doing the same work, different segments with entirely different compensation packages for labour. It extended distinct advantages to SBI staff by signing separate wage pacts in respect of SBI and the rest of the banks from time to time and uprooted the essence of the Indian Constitution that guarantees equity and Equality as Fundamental Rights. This is the major contribution of the IBA to the country when it is celebrating the Platinum Jubilee of Independence. IBA made a vague jumble of the entire things. SBI people now have two retirement benefits in addition to Gratuity viz. Provident Fund and Pension and the rest in the Industry have only one. RBI employees whose are doing mere monitoring role without their work having any direct productivity are also getting a Pension since RBI extended an option for Pension to them in 2000. IBA is now the single party at default leaving the work force in other banks in the lurch.

Can any one see so many blunders in any other industry? The history of Indian banking can never pardon the conductors of the industry unless they refine themselves and render justice to those who sacrificed their entire career at the altar of the organizations. Extension of fresh option for Pension in its original form without deviations is the one and only permanent solution to garner industrial peace. You now have the option to correct the past mistakes of IBA and make it rest on solid foundation or to continue the sinful show as at present in the most vulgar form. It is my earnest desire that you will spare some thoughts over the issue and settle it in a befitting way to bring it to a logical conclusion and to garner industrial peace and uninterrupted service to the public. Either way, I will have material since I am venturing shortly into the publication of a media item with a team of experts that can excavate and bring to light the various (im)prudent banking stories to run parallel to the “Indian Banker”. Those narrated herein can be elaborated into wonderful pieces and thanks to the Right to Information Act, regular collection of materials to ensure a perennial supply of material concerning write offs, renovations of offices with ulterior aim, tenders etc can be had. The tall claims put forth in the Indian Banker can be examined with facts and figures in it. The CPIOs of banks will also have good work collecting the information relating to write off, securities released in the process etc. from the lower offices and supplying to my team.

With regards, and thanking You, I remain.

Yours faithfully,

C N Venugopalan

PMO Letter Received

C N Venugopalan

Ex- Manager,

Union Bank of India

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994email: cnvenu@yahoo.com

Comrades, 15th February, 2007

Sub: Second Option on Pension – A major break through

With profound happiness, I inform that the Pension Option issue is in the process of being sorted out. Prime Minister’s Office has given a direction to the Secretary, Financial Sector, Ministry of Finance to examine the issue and to take appropriate steps in response to my communication to Dr. Manmohan Singh, Hon’ble Prime Minister . An extract of the letter of the PMO along with a copy of the letter I sent to the prime Minister are appended for your information.

We can hope that the matter will be resolved while the budget session of the Parliament examines the issue in the current month.

Kindly send e-mail messages to your counterparts in other branches/banks

With revolutionary regards,

Yours comradely,

C N Venugopalan

Sub : PETITION OF Sh. C N VENUGOPALAN,

“NANDANAM” KESARI JUNCTION.

NORTH PARAVOOR, KERALA–683513

A copy of letter dated 10-JAN-2007 received in this office from Sh. C N VENUGOPALAN is forwarded herewith for action as appropriate.

( O.D. SHARMA)

SECTION OFFICER

SECRETARY, FINANCIAL SECTOR, M/O FINANCE

------------------------------------------------------------------------------------------------------------------

PMO ID NO. 09/ 3 / 2007-PMP-4/750170 Dated – 22-JAN-2007

Copy for information to :-

Sh. C N VENUGOPALAN

NANDANAM” KESARI JUNCTION.

NORTH PARAVOOR, KERALA–683513

( O. D. SHARMA)

SECTION OFFICER

C N Venugopalan

Ex- Manager,

Union Bank of India

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994

Dr Manmohan Singh, 10th January, 2007

Prime Minister of India,

Office of the Prime Minister,

New Delhi – 110 001

Respected Sir,

Sub: Pension for all Bank Employees.

At the threshold of the New Year, 2007, I wish you a very bright and Happy New Year and take the privilege of addressing a grave issue, to the head of the Cabinet of the country for bringing a logical conclusion to it. The issue is such a malignant one for the country as a whole since it involves discrimination of similarly placed in the sixth decade of independence in the democratic India. There is dual citizenship in the banking space which a leader like you can not reconcile. I belong to the school of thought that identifies you as the only person who can easily resolve this burning issue of bank men for ensuring social justice. Being the head of the Cabinet, you will be most interested in doing away with violation of the Constitution, which poses a question mark before the entire nation and to its heritage.

I am enclosing for your information a copy of the fortnightly, “Business Economics” (Dec. 16 – 31, Pages 22 & 23) containing an article under the caption “Indian Banking Sector: A Saga of labour unrest” regarding denial of second option on Pension in the Banking Industry. The Indian Banks Association and the Government have denied natural justice to about eight lakhs of bank men and their families leaving them in the lurch at old age by keeping them out of the ambit of Pension. The hard work they put in, from dawn to dusk, for thirty to forty years, for making the banks what they are now, does not qualify for pension, in the eyes of the authorities. How can such an anomaly be allowed to continue in a democratic country that claims to ensure social security to the workers in their old age ?.

I have vividly clarified in the annexure to this letter as also in the fortnightly that banks can extend Pension Option to all the employees without incurring any additional costs and confining expenditure to the committed costs obtaining in the year 1995. What is needed, is only a positive approach to the issue and the preparedness to correct the mistakes, those responsible have committed.

Our country is drawing itself close to the diamond jubilee of Independence and discrimination among similarly placed is totally unwarranted. Any sensible person can not reconcile such a situation. It is opposed to statute and run counter to the principles of equity and equality enshrined in the Constitution. The gravity of the situation gets intensified since the Government itself has become instrumental to the discrimination. While conceding to the demands for hike in Pension of SBI employees who struck work for eight days in April, 2006, the Hon’ble Minister for Finance became a party to creating a new class of employees with three retirement benefits viz. Gratuity, Pension and Provident Fund, in the banking industry. Their counterparts in the rest of the banks including the subsidiary banks of SBI have only two benefits viz. Gratuity and Provident Fund or Pension. The SBI employees demanded parity in Pension with the Pension Scheme in other banks, a benefit which was not uniformly available to all employees in such banks. The Hon’ble Minister, who, while swearing in, took the oath in the name of the Constitution, assuring to protect its sanctity, became a party for violating it, by conceding to their demand.

The IBA, the body of bankers, the Government that sanctions the absurd proposals of IBA and the various trade unions that failed to sort out the issue – all stand in the defense box now. The bureaucracy that committed the mistakes with the least intelligence lacks wisdom and magnanimity to amend itself and correct them. The present situation calls for interference of leaders, with wisdom and understanding, which would infuse justice and fair play, to rescue the oppressed and deceived. As a pragmatist who opposes injustice and discrimination in the country, you will kindly direct the Hon’ble Minister of Finance to ensure justice to the bank men for saving them from agony at old age. The steps you take in the direction will be hailed by about eight lakhs bank men, both working and retired, and their families. They would imbibe in them allegiance to you and to the party for sorting out the issue in a befitting manner. I shall be circulating this letter among the bank employees, through e-mail or other media so that the role you play in the matter is well acknowledged. It is my earnest request to you to kindly interfere in the matter and resolve it, for upholding the values of the country and for averting labour unrest on this score.

A gist of anomalies in the Pension Scheme is annexed to give you a proper idea on it. I am sure you will come to a conclusion that all bank employees should be uniformly extended three retirement benefits as in the case of SBI employees. Should there be genuine financial constraints for granting Pension as third benefit immediately, it has to be extended as a second benefit to all bank employees with the minimum qualifying service, who are working and retired for the time being.

With warm regards, I remain.

Thanking You,

Yours faithfully,

C N Venugopalan

Ex- Manager,

Union Bank of India

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994email: cnvenu@yahoo.com

Comrades, 15th February, 2007

Sub: Second Option on Pension – A major break through

With profound happiness, I inform that the Pension Option issue is in the process of being sorted out. Prime Minister’s Office has given a direction to the Secretary, Financial Sector, Ministry of Finance to examine the issue and to take appropriate steps in response to my communication to Dr. Manmohan Singh, Hon’ble Prime Minister . An extract of the letter of the PMO along with a copy of the letter I sent to the prime Minister are appended for your information.

We can hope that the matter will be resolved while the budget session of the Parliament examines the issue in the current month.

Kindly send e-mail messages to your counterparts in other branches/banks

With revolutionary regards,

Yours comradely,

C N Venugopalan

Sub : PETITION OF Sh. C N VENUGOPALAN,

“NANDANAM” KESARI JUNCTION.

NORTH PARAVOOR, KERALA–683513

A copy of letter dated 10-JAN-2007 received in this office from Sh. C N VENUGOPALAN is forwarded herewith for action as appropriate.

( O.D. SHARMA)

SECTION OFFICER

SECRETARY, FINANCIAL SECTOR, M/O FINANCE

------------------------------------------------------------------------------------------------------------------

PMO ID NO. 09/ 3 / 2007-PMP-4/750170 Dated – 22-JAN-2007

Copy for information to :-

Sh. C N VENUGOPALAN

NANDANAM” KESARI JUNCTION.

NORTH PARAVOOR, KERALA–683513

( O. D. SHARMA)

SECTION OFFICER

C N Venugopalan

Ex- Manager,

Union Bank of India

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994

Dr Manmohan Singh, 10th January, 2007

Prime Minister of India,

Office of the Prime Minister,

New Delhi – 110 001

Respected Sir,

Sub: Pension for all Bank Employees.

At the threshold of the New Year, 2007, I wish you a very bright and Happy New Year and take the privilege of addressing a grave issue, to the head of the Cabinet of the country for bringing a logical conclusion to it. The issue is such a malignant one for the country as a whole since it involves discrimination of similarly placed in the sixth decade of independence in the democratic India. There is dual citizenship in the banking space which a leader like you can not reconcile. I belong to the school of thought that identifies you as the only person who can easily resolve this burning issue of bank men for ensuring social justice. Being the head of the Cabinet, you will be most interested in doing away with violation of the Constitution, which poses a question mark before the entire nation and to its heritage.

I am enclosing for your information a copy of the fortnightly, “Business Economics” (Dec. 16 – 31, Pages 22 & 23) containing an article under the caption “Indian Banking Sector: A Saga of labour unrest” regarding denial of second option on Pension in the Banking Industry. The Indian Banks Association and the Government have denied natural justice to about eight lakhs of bank men and their families leaving them in the lurch at old age by keeping them out of the ambit of Pension. The hard work they put in, from dawn to dusk, for thirty to forty years, for making the banks what they are now, does not qualify for pension, in the eyes of the authorities. How can such an anomaly be allowed to continue in a democratic country that claims to ensure social security to the workers in their old age ?.

I have vividly clarified in the annexure to this letter as also in the fortnightly that banks can extend Pension Option to all the employees without incurring any additional costs and confining expenditure to the committed costs obtaining in the year 1995. What is needed, is only a positive approach to the issue and the preparedness to correct the mistakes, those responsible have committed.

Our country is drawing itself close to the diamond jubilee of Independence and discrimination among similarly placed is totally unwarranted. Any sensible person can not reconcile such a situation. It is opposed to statute and run counter to the principles of equity and equality enshrined in the Constitution. The gravity of the situation gets intensified since the Government itself has become instrumental to the discrimination. While conceding to the demands for hike in Pension of SBI employees who struck work for eight days in April, 2006, the Hon’ble Minister for Finance became a party to creating a new class of employees with three retirement benefits viz. Gratuity, Pension and Provident Fund, in the banking industry. Their counterparts in the rest of the banks including the subsidiary banks of SBI have only two benefits viz. Gratuity and Provident Fund or Pension. The SBI employees demanded parity in Pension with the Pension Scheme in other banks, a benefit which was not uniformly available to all employees in such banks. The Hon’ble Minister, who, while swearing in, took the oath in the name of the Constitution, assuring to protect its sanctity, became a party for violating it, by conceding to their demand.

The IBA, the body of bankers, the Government that sanctions the absurd proposals of IBA and the various trade unions that failed to sort out the issue – all stand in the defense box now. The bureaucracy that committed the mistakes with the least intelligence lacks wisdom and magnanimity to amend itself and correct them. The present situation calls for interference of leaders, with wisdom and understanding, which would infuse justice and fair play, to rescue the oppressed and deceived. As a pragmatist who opposes injustice and discrimination in the country, you will kindly direct the Hon’ble Minister of Finance to ensure justice to the bank men for saving them from agony at old age. The steps you take in the direction will be hailed by about eight lakhs bank men, both working and retired, and their families. They would imbibe in them allegiance to you and to the party for sorting out the issue in a befitting manner. I shall be circulating this letter among the bank employees, through e-mail or other media so that the role you play in the matter is well acknowledged. It is my earnest request to you to kindly interfere in the matter and resolve it, for upholding the values of the country and for averting labour unrest on this score.

A gist of anomalies in the Pension Scheme is annexed to give you a proper idea on it. I am sure you will come to a conclusion that all bank employees should be uniformly extended three retirement benefits as in the case of SBI employees. Should there be genuine financial constraints for granting Pension as third benefit immediately, it has to be extended as a second benefit to all bank employees with the minimum qualifying service, who are working and retired for the time being.

With warm regards, I remain.

Thanking You,

Yours faithfully,

C N Venugopalan

Letter to IBA

C N Venugopalan

Ex- Manager, Union Bank of India

& Financial Consultant

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994

The Chairman, 14th March, 2006

Indian Banks Association,

Block No. 2 & 3,

6th Floor, Stadium House,

81-83, V N Road,

Mumbai – 400 020

Dear Sir,

Pension Option in Banks and its imperative need

You must have received my earlier letter dated 6th February, 2006 regarding extension of Pension Option afresh to employees in Banks.. Though silence cannot be construed legally as a mode of acceptance, I am glad that none of my statements have been contradicted. The Prime issue that looms large in the Banking Horizon invariably is that of a fresh Pension Option. Fresh Option for Pension is already a committed item in view of the legal onus cast on Banks on account of the scrapping of the Forfeiture of service clause from the Pension Regulations of the Bank. The option given in RBI in 2000 is another compelling reason. Pension is in no way a consideration for a simple option exercised. It is the consideration for services rendered. The emphasis the Constitution Bench of the Supreme Court has assigned to the right of an employee to Pension in Nakara Case (17 12 2002) is also a statute that reinforces the issue. The decision is an indirect statute that has a bearing on the Banking Industry and has to be honoured. It is utterly surprising that IBA that watches all legal decisions affecting Bankers and bring them out in its journal has not taken any steps to fall in line with the decision. Ignorance of law is no excuse and non-compliance with the statute is contempt of Court. While commissioning Pension Scheme in 1995, Banks had ridiculously went to the extent of including under it, all those who retired on or after 01 01 1986, (about one decade) just for paying Pension to one Tharakeswar Chakraborthy, the veteran Trade Union leader who retired in the year 1986. From the angle of significant accounting policies, the correct determination of profit of Banks requires provision of all expenditure including legitimate establishment expenses like Pension. Since a number of suits are in the Courts regarding Pension Payment, it becomes inevitable that adequate provision be made in the books for Pension liability for ascertaining the exact profit figures of Banks. Distributing the inflated profit without adeqauate provisioning is totally unscientific and tantamount to robbing Peter to pay Paul. Extension of fresh option is something, which has to be done invariably and which can be done without Banks incurring any additional costs. The following will give a very vivid picture:

1. At the time of commissioning Pension Scheme, Banks had the liability to make PF Contributions in respect of all employees on the rolls in 1995 till their retirement. This was an already committed cost. Such contributions could notionally be worked out and ploughed back into the Pension Fund to augment it.

2. In respect of those who are recruited (who are encompassed by the Pension Scheme compulsorily) also, keeping the pay package at the same level, the contributions could be put into the Pension Fund.

3. The balances available in the PF accounts of the present PF stream employees who may opt for Pension through fresh Pension Option and the future contributions in respect of till their retirement (which was also a committed cost of the Banks at the time of commissioning the Pension Scheme) should also be made available for augmenting the Pension Fund.

4. Judicious investment of all the moneys will ensure substantial returns that will augment the Pension Fund substantially

5. The exercise pertaining to the above three items have to be worked out for the past one decade and transferred into the Pension Fund.

6. All the employees who opt for Pension are not going to retire in a lot and create a Pension Obligation for the Banks and the liability will be growing only in a phased manner. On account of death and other cessation of Pension of the present pensioners, cessation of family Pension, the liability will be getting extinguished in several cases and some sort of balancing will be available in the process.

7. A fresh Option will ultimately result in substantial establishment expenditure as it may induce a number of employees to quit the present jobs with a less attractive compensation package.

8. Option to remain in PF in other words should be retained as a terminal benefit to only those who need it for personal some personal reasons or to those who will not have qualifying service to be eligible for Pension.

Financial Constraints –an illusion

It was true that some of the Banks like Syndicate Bank, UCO Bank Indian Bank etc were ailing ones a decade back. All of them have turned corner and some have shown fantastic working results. Want of paying capacity is not at all there. Banks shed several crores through write off and relief to defaulters in circumstances that are not genuine in many a case. Ground rules and code of ethics in business are forgotten altogether. In the name of competition, for applying cosmetics to the performance, the prodigal banking barons drain out plenty of Crores every year. On one side they join hands together by sharing ATMs and establish common service network and the other side they pull the legs of one another. Banks competing with each other take over advance accounts from others by offering lesser and lesser rates. The customers who have bargaining power gain and the amounts they gain represent loss of vital fluids of the industry. The deregulated rates of interest further offer scope for corruption and nepotism. The deserving poor never get a fair treatment. The other industries like those of Ambanis, Birlas, Dalmia, Tatas etc flourish and their workmen also get all good perquisites. The banks which finance in furtherance of such industries do not have capacity for paying Pension to the staff who toiled through and through for their organizations. What a pity? The amounts payable to them by way of establishment expenses are drained out of the industry in several Crores. The benefit is accruing to the key men heading the different Banks alone. RBI and the Government have no control and they sit enjoying like watching a Cricket.

We are also aware, several Banks including a PSB viz. New Bank of India monitored by RBI and controlled by stalwarts in the industry vanished into obscurity. Paravoor Central Bank Ltd., Nedungadi Bank, Bank of Madura etc. are some of them. Where is the control and what is the control? Where is the integrity of the key men who run the Banks? Banking industry has provision to contain such gigantic losses arising out of manipulations and mismanagement. There is however no money to provide bread and butter to those who toiled and sacrificed their entire career for the organizations they served

Thanks to the Information Act, 2005, one can requisition information relating to the take over accounts from any Bank and ascertain the extent of money thrown out for keeping the false prestige and cosmetics of the stars in the industry and publish it in media columns.

Again, money goes out from the system to safeguard the blunt and blatant policies of the executives. To cite a simple example, the terms of offer of VRS contained an offer to pay Pension to those who embraced the scheme as per the Pension Regulations. Pension Regulations contained a provision to allow grace period of five years to those having 28 years of service. Banks did not honour the commitment and arbitrarily disallowed the notional grace period. When some Pensioners obtained a favourable decree, BOI took the matter to the Apex Court knowing for certain the hollow nature of the suit just for preventing and delaying the flow of justice to the decree holders. Their action has caused inconvenience and loss to a lot of people, including some who are not directly involved. The Bank is trying to patch a hole with darkness and playing the game with the public money at its command. The decision makers capitalize out of the fact that they do not have to spend anything out of pocket, but just have to take a decision. The matter is simple and does not involve any intricate legal issue. Banks are used to making a mockery of the Court also. There exists good scope for a PIL petition in the matter invoking the concerned Bank.

As for me, it was the humiliating experiences with the employer that forced me to quit the employment through VRS at a young age of 49. After rendering yeoman service for about 30 years, the employer sent me out without hosting even a cup of tea. The Bank had provisions to expend a sum of Rs.200/- when an employee retires. The Bank informed all administrative offices that VRS retiree is not entitled to the expenditure in spite of the fact that it is not an amount paid to the employee but an expenditure incurred by the Bank itself for holding a small get together meeting. Again, the Bank did not pay the amount of gratuity correctly and in time. The top executives lent a deaf ear to the entreaties. Ultimately, the issue had to be taken to the Labour Department to get redressed. The claim was confirmed and the Bank paid about Rs.5 .00 Crores to all the VRS retirees taken together and my share was about Rs.17, 000/-. What a pity on the part of great institution in making an unholy profit out of the sweat of the brow of an employee!

Besides, after applying for Voluntary Retirement, the Bank declined the Privilege Leave applied for with due notice citing exigency of service at a time it had identified surplus manpower and came with a scheme for shedding surplus manpower. I was having maximum PL accumulation and the period of leave declined was not added to my PL account. In fact, at the fag end of my career, I was not paid for 15 days of work the Bank forcibly and arbitrarily extracted. Likewise, whereas the Service Regulations provided for a mandatory three months notice on either side for quitting / expelling, I was intimated about acceptance of my Voluntary Retirement application on 30th March, 2001 and the employer relieved me on 20th April, 2001. A sum equivalent to 70 days pay is still due to me as pay in lieu of notice. The promised compensation payable within a maximum period of 21 days was not given to me in full. I had accepted the capital forbearance of my future services of about 10 years’ future service in anticipation of the promised compensation, it was not paid in full yet. I had to issue a notice of demand to the employer demanding the remaining amount and on the expiry of the notice period the amount already paid under VRS was forfeited. The VRS has hence become null and void and I am deemed to be in the services of the employer as on date. A suit is in the High Court and the decision is awaited. The matters are made known to you without prejudice to the suit filed in the Court merely to apprise you of the shallow games of Banks. I have to pursue some work or other until the normal age of retirement at least and hence indulging in it to do some good to the industry that brought me up. And my strength is that of millions since my cause is just and legal.

Coming back to the point, I further state that the Trade Unions in Banks are charged with the issue of fresh Pension Option and come out with it any time. In the wake of the legitimacy of the requirement for grounds enumerated, if people heading the Banks and IBA are sensible people, they have a responsibility to come forward to allow the just right of the employees who were on the rolls of Banks in 1995 to have a fresh option instead of unnecessarily making a trial of strength bargaining on the legitimate issue and conceding later. It is a matter to be known whether those concerned would develop the wisdom to come forth voluntarily for settling the issue amiably or remain power blind and take recourse to the precedents of succumbing to the trade union pressure later. If Banks led by IBA is showing an untoward attitude despite bringing to your information about the verdict of the Constitution Bench of Supreme Court, I will be free to move a PIL petition in the Apex Court explaining all the circumstances very vividly for averting the threat of disruption of normalcy in Banking and inconvenience to the public besides bringing it in media and before the Government.

A copy of this letter is being sent to RBI also for its information.

Yours faithfully,

C N Venugopalan

Divided Forum of Bank Unions

C N Venugopalan

Ex- Manager, Union Bank of India

Vice President, UBI Retiree Officers’ Association (Kerala)

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994 e-mail:ceeyenvee@gmail.com

Shri. H N Sinor, 3rd May , 2007

Chief Executive,

Indian Banks Association,

Mumbai

Dear Sir,