Unveiling truth about Pension Option afresh

• While Pension Scheme was introduced in 1995 some unions advocated it for all while others propounded that CPF would be beneficial and prevented many from exercising option

• The former wanted to ensure that those who did take their advice never get a chance again

• The latter remained firm on their stand and befooled members saying that CPF was still beneficial

• Both went in parallel lines that would never meet

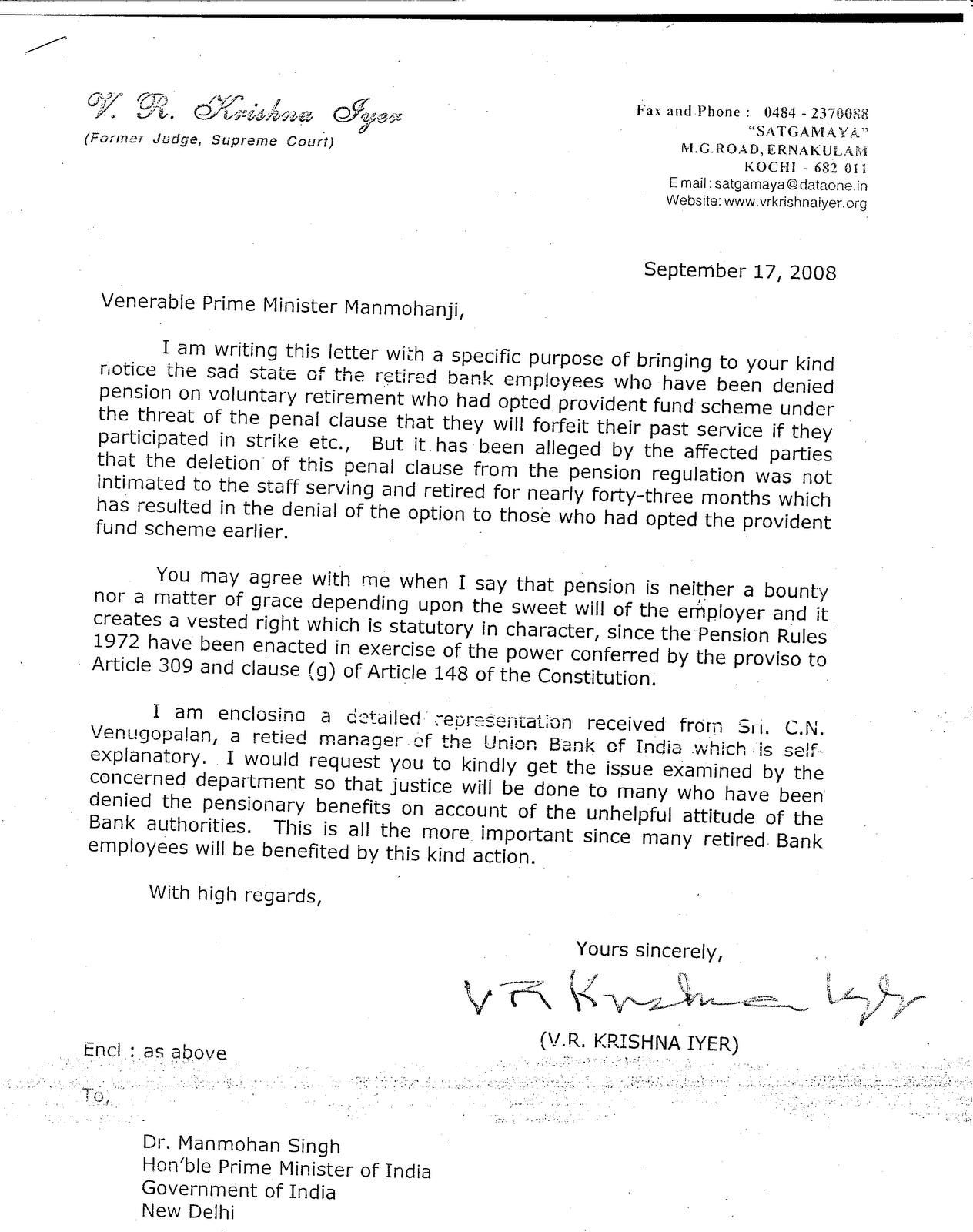

• Many employees could not join the Scheme because of the infusion of the forfeiture of service clause in the final Pension Regulations

• Some who had opted in terms of draft Regulations quit the scheme when the forfeiture of service clause was infused when banks permitted revocation

• Revocation was null and void since the draft and Government sanctioned Regulations stated that “option once exercised shall be final and irrevocable”

• Banks did not extend and unions did not procure a fresh option to those who could not opt earlier when the penal clause remained in the Regulations upon deletion of the penal clause on 27th February, 1999 which created a legal obligation to do so

• Unions drove all those retired to various courts without extending any help and suits and appeals decided against employees created a formidable obstacle which could not be cleared easily

• Government categorically stated that it would not open the issue of Option again.

• Unions agreed in 2005 with IBA not to open the issue again, virtually selling out the fundamental right.

• Even as option was a legally vested right of all employees in 1999, Unions joined hands with managements and did not perform for it

• Pension Option became a shattered dream of bank men and a stale item with the passage of time and vanished from the charter of demand of all unions by 2005

• My vehement criticisms and a circular letter (dated 10th January, 2006) sent on all India bases explaining the lapse of the Unions and illegality IBA perpetrated brought the issue to lime light once again. But for the prodding and propulsion I did, the issue buried for would never have surfaced out again

• After a series of agitations, a MOU was signed on 25th February, 2008 between IBA and UFBU to the effect that the issue would be settled within three months.

• The time frame of the MOU of 25th February, 2008 was breached as Unions did not evince any interest in concluding things within the time frame.

• The issue got mixed up with wage talks and prolonged to add to the hardships of those retired. Working people suffered for ever since IBA made a foul bargain in the name of Pension burden by offering a low hike to bank employees who toil for six days when government employees who work merely for five days got a hike of 40 percent.

• Unions once again partially sold out the rights of bank men by agreeing to 70:30 sharing formula for the pension burden.

• Even as a final agreement was reached on 7th August 2009 on 17.50 percent hike and Pension Option, the next round of sitting could be arranged only on 27th November, 2009 after lapsing three and a half months

Those who opposed a fresh option tooth and nail now say that they achieved the “second option” when none has got the first option as per the Regulations sans forfeiture of service clause

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment