C N Venugopalan

Ex- Manager, Union Bank of India

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994

No.20091230 30th December, 2009

The Editor,

Business Line.

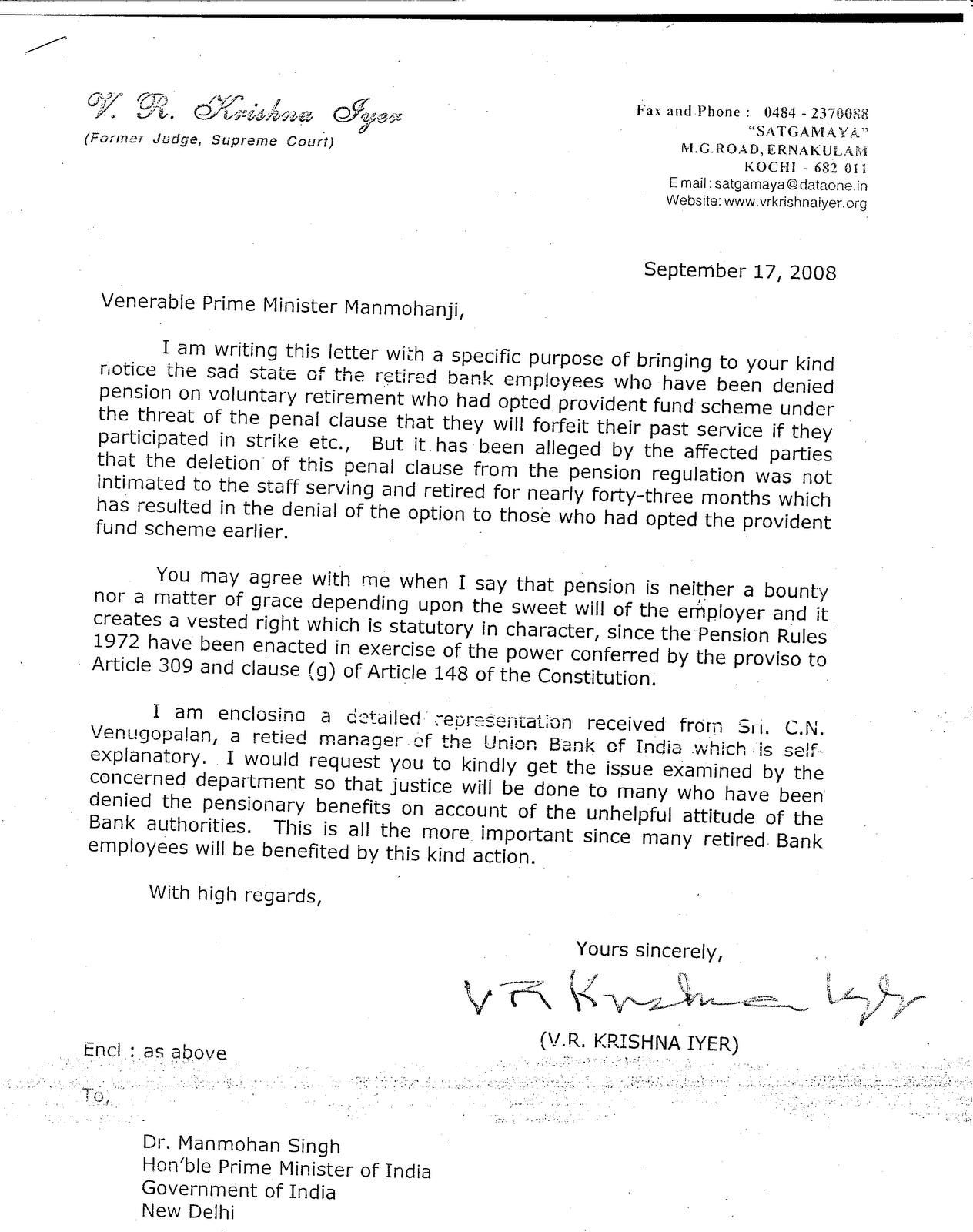

Bank Men and Wage hike

The IBA recently settled a pay hike of 17.50 percent and a fresh option for bank men, including the retired who stayed away from the scheme when it contained a penal clause. Bank unions blow the trumpet saying that the percentage of wage hike is the highest one ever secured. The statistically precise statement becomes quite unacceptable in the context of the 40 percent pay hike given to five days working government employees in the pre-election phase when the six days working bankers are settled for 17.50 percent, which is 56.25 percent less than the pay hike to the former.

Pension Option is a benefit already given in 1995 and later denied unlawfully to majority of employees. The final and irrevocable options of certain employees were revoked and others who could not opt when the scheme contained the penal clause were not given a fresh chance when the clause was deleted in 1999. Unions and directors representing officers and workmen remained mute spectators while the fundamental right of the people they represented was taken away. Bipartite Settlement inked in 2005 stated that the issue of fresh option cannot be reopened. Retired, who were victims were driven to courts and the apex court that heard appeals rejected the plea of the bank men in 2001. Government too took a negative stand that fresh option can not be considered at any rate causing hardship to the retired for years.

Even as public sector banks ( excepting State Bank of Saurashtra and State Bank of Indore whose data were not available) made incremental profits of Rs. 32,148.77 Crores for past three years over the 2006 level, IBA worked out a deficit of Rs.1800 Crores for meeting the Pension burden asking the employees to share this 30 percent of the identified liability. The incremental profit of 13 prominent private sector banks for identical period stood at Rs. 19,486.14 Crores. The hike in interest income of the PSBs was Rs. 1,19,919.63 Crores and that of the private sector banks was Rs. 75,780.05 Crores. Spurt in profits and interest income, makes the demand of IBA on the employees to share a portion of the Pension Burden a real plight. Want of financial muscles to bear legitimate establishment expenditure proves as a mere extenuation while analyzing facts and figures.

The Agricultural Debt waiver in 2008 came to Rs.70,000 Crores and other normal write off during the past three years stood at about Rs.25,000 Crores. It takes any Indian to utter surprise when banks which could splendidly bear the burnt of the Rs.95000 Crores on write off find it difficult to extend a reasonable package to the workforce and make a foul bargain for Rs.1,800 Crores for paying the pension.

Pension Regulations have specifically excluded the resigned employees from its purview albeit possessing the prescribed minimum service qualifying for pension. Mode of exit ought to be immaterial and Pension Scheme has to be fine tuned to encompass resigned too when banks are paying pension to VRS retirees who were given a special package for quitting employment. Resignation is the purest form of Voluntary Retirement embraced voluntarily whereas the VRS is a scheme of induced retirement through special incentives offered.

The Minister of Finance and members of Parliament who have taken oath in the name of the Constitution of the country consenting to treat identical people equally will be at a default if they shut their eyes before realities and fail to extend uniform treatment to bank men of all sort. The fact that Bank employees take their salaries from the profits banks make and not from the exchequer should also be taken care of while settling their deal vis-à-vis government employees.

Yours faithfully,

C N Venugopalan

Supporting data testifying the facts enclosed

Supporting data

Profits of Public Sector Banks & SBI group

PROFITS Rs. Crores

March March March March March

2005 2006 2007 2008 2009

PNB 2707.21 2874.77 3230.64 4006.24 5744.35

BOI 340.05 701.44 1123.17 2009.4 3007.35

UBI 719.06 675.16 845.39 1387.03 1726.55

CBI 357.41 257.42 498.01 550.16 571.24

Canara Bank 1109.51 1343.22 1420.81 1565.01 2072.42

IOB 651.36 783.34 1008.43 1202.34 1325.79

UCO Bank 345.65 196.65 316.1 412.16 557.72

Syndicate Bank 402.90 536.50 716.05 848.06 912.82

Allahabad Bank 541.79 706.13 750.14 974.74 768.6

Vijaya Bank 380.57 126.88 331.34 361.28 262.48

BOM 177.12 50.79 271.84 328.39 375.17

Corporation Bank 402.16 444.46 536.15 734.99 892.77

Indian Bank 408.49 504.48 759.77 1008.74 1245.32

Dena Bank 61.00 72.99 201.56 359.79 422.66

BOB 676.84 826.96 1026.47 1435.52 2227.2

Andhra bank 520.1 485.5 537.9 575.57 653.05

OBC 760.81 803.16 826.81 840.94 905.42

SBM 206.26 216.72 249.23 318.85 336.91

SBH 226.49 301.4 427.05 505.5 615.81

SBI 4304.52 4406.67 4541.31 6769.12 9121.24

SBT 247.13 258.68 326.28 386.11 607.84

SBS

SBBJ 205.65 145.03 305.8 315 403.45

SBP 287.07 303.11 366.53 413.73 531.54

State Bank of Indore

16039.15 17021.46 20616.78 27308.67 35287.70

2006 Profits 17021.46 17021.46 17021.46

Incremental profit 3595.32 10287.21 18266.24

Total Increase from 2006 level 32148.77

Profits of selected private sector banks

Rs. Crores

Name of Bank March March March March March

2005 2006 2007 2008 2009

Federal Bank 90.09 225.21 292.73 368.05 500.49

South Indian Bank 8.70 50.90 104.12 154.32 194.75

Axis Bank 334.58 485.08 659.03 1071.03 1815.36

ICICI Bank 2005.20 2540.07 3110.22 4157.73 3758.13

IDBI Bank 307.26 560.89 630.31 729.45 858.53

HDFC Bank 665.56 870.78 1141.45 1590.18 2244.95

City Union Bank 233.16 256.10 331.49 446.69 616.44

J & K Bank 1006.89 1170.48 1386.47 1954.76 2374.91

Karnataka Bank 542.14 754.36 934.92 1213.43 1490.39

IndusInd Bank 728.67 706.28 1092.10 1436.13 1621.58

Yes Bank -10.08 89.42 344.80 926.05 1523.03

DLB -21.60 9.51 16.14 28.46 57.45

Bk of Rajastan 296.76 278.34 475.05 779.36 1047.92

6187.33 7997.42 10518.83 14855.64 18103.93

2006 Profits 7997.42 7997.42 7997.42

Incremental profit 2521.41 6858.22 10106.51

Total Increase from 2006 level 19486.14

Interest Income of Public Sector Banks

March March March March March

2005 2006 2007 2008 2009

PNB 4453.11 4917.39 6022.91 8730.86 12295.30

BOI 3794.64 4396.72 5739.86 8125.95 10848.45

UBI 2905.24 3489.43 4591.96 6360.95 8075.81

CBI 2829.93 3005.51 3759.79 5772.48 8226.72

Canara Bank 4421.50 5130.01 7337.73 10662.94 12401.24

IOB 2095.53 2339.10 3721.27 5288.79 6771.81

UCO Bank 818.66 852.10 944.75 953.95 1201.62

Syndicate Bk 2063.80 2169.55 3890.02 5833.56 6977.60

Allahabad Bank 1072.62 1024.15 1099.91 1479.51 1901.15

Vijaya bank 1109.77 1339.02 1751.16 3058.42 4113.02

BOM 1486.04 1502.90 1627.84 2311.79 3035.03

Corporation Bank 1120.42 1399.66 2052.37 3073.24 4376.37

Indian Bank 1567.00 1854.34 2412.62 3159.08 4221.82

Dena Bank 1038.58 1037.46 1263.16 1817.14 2383.07

BOB 3452.15 3875.09 5426.56 7901.67 9968.17

Andhra bank 1204.42 1505.39 1897.79 2870.00 3747.71

OBC 2048.22 2513.85 3473.58 5156.17 6859.97

SBM 623.03 735.09 1092.91 1732.10 2409.02

SBH 1268.64 1319.51 1654.55 2134.53 4242.71

SBI 18483.38 20159.29 23436.82 31929.08 42915.29

SBT 1112.16 1343.49 1698.44 2476.82 2840.60

SBS

SBBJ 871.98 972.88 1435.42 2112.98 2707.06

SBP 1156.96 1464.87 2059.63 3419.62 4676.32

37481.63 42351.67 57013.28 82556.5 107404.86

2006 Income 42351.67 42351.67 42351.67

Incremental Income 14661.61 40204.83 65053.19

Total Increase from 2006 level 119919.63

Interest Income of Private Sector Banks

Rs, Crores

March March March March March

Name of Bank 2005 2006 2007 2008 2009

Federal Bank 688.75 836.73 1084.96 1647.43 1999.92

South Indian Bank 452.07 451.14 609.09 915.10 1164.04

Axis Bank 1192.98 1810.56 2993.32 4419.96 7149.27

ICICI Bank 6570.89 9597.45 16358.5 23484.24 22725.93

IDBI Bank 2467.87 5000.82 5687.49 7364.41 10305.72

HDFC Bank 1315.56 1929.50 3179.45 4887.12 8911.10

City Union Bank 179.84 186.61 232.56 396.18 561.83

J & K Bank 952.99 1042.53 1131.48 1623.79 1987.86

Karnataka Bank 523.04 652.07 836.39 1101.71 1443.83

IndusInd Bank 718.89 873.19 1228.85 1579.86 1850.44

Yes Bank 11.85 104.72 416.26 974.11 1492.14

DLB 119.06 126.89 149.77 213.50 286.80

Bk of Rajastan 308.91 317.06 439.4 735.60 998.45

15502.7 22929.27 34347.52 49343.01 60877.33

2006 Profits 22929.27 22929.27 22929.27

Incremental profit 11418.25 26413.74 37948.06

Total Increase from 2006 level 75780.05

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment