Thursday, September 25, 2008

ACTUARIAL EXERCISE ON PENSION

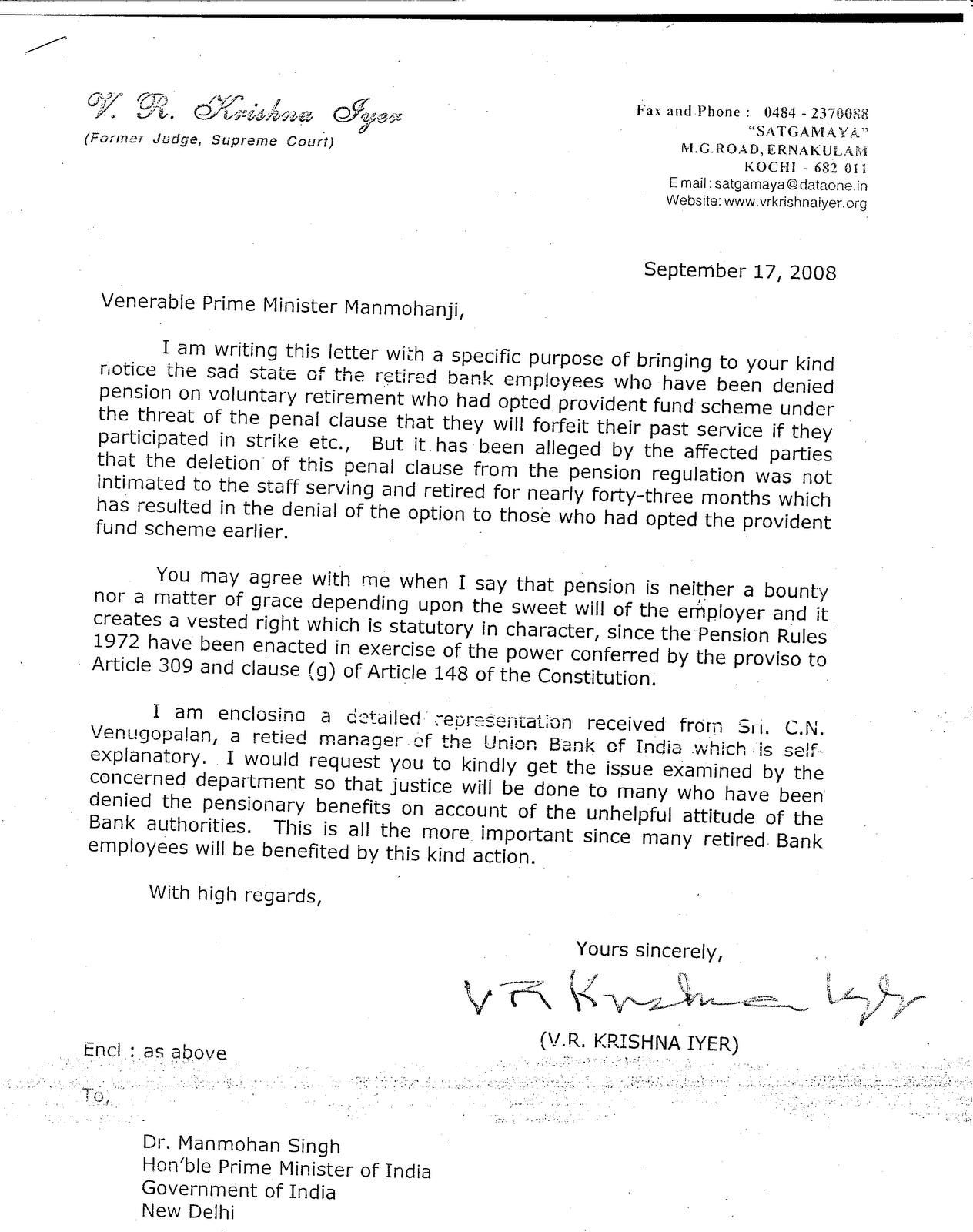

C N Venugopalan

Ex- Manager, Union Bank of India &

Vice President, Union Bank of India Retired Officers’ Association (Kerala)

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994 e-mail: ceeyenvee@gmail.com

Shri. M B N Rao, 26th April, 2008

Chairman,

Indian Banks Association, For kind personal attention

Mumbai,

Dear Shri. Rao,

Actuarial exercise on Pension

Children, smelling defeat while playing, resort to playing foul, violating all ground rules to spoil the entire game. Among the elderly, scoundrels playing the game of cards insert fake cards and win the game without the opponent seeing the mischief. If at all found out, they use muscle power and run away with the bet money. The banking dignitaries are not far from such people and act sans dignity while dealing with pension related issues. They ignore or violate cardinal rules and ethics, play foul and take shelter under power of purse and authority. They break the Regulations which they themselves made and behave like people sans self respect.

I am sorry to note that you have not cared to respond to any of my letters sent to you in your capacity as the Chairman of IBA and also personally for the simple reason that you do not have any justification to offer in respect of the absurdities and mistakes the IBA has committed while implementing schemes like VRS and while paying unauthorized pension to several people - it paid superannuation pension payable on attaining the age of 60 much before that to VRS retirees without Pension Regulations containing an enabling provision and subsequently amended Regulation 28 with retrospective effect to escape the accountability of wrong payment - and at the same time refusing Pension to several others who have the qualifying period of service to be eligible for pension and are legally entitled to it .

The IBA is again attempting to engender fresh issues that will precipitate while going on examining feasibility of extending second option on Pension with reduced benefits than what is extended originally. Fresh actuarial valuation is insignificant altogether since all those in service of the banks in 1995 are entitled to fresh option in the wake of the February, 1999 amendment to Regulations. Banks at that time, torpedoed all legal principles, kept the target group uninformed by publishing it in the gazette alone, contravening the usual practice of circulating in English and Hindi through appropriate internal communication.

Likewise, while reckoning the qualifying service, the grace period of five years to be added to actual number of years of service as provided in the Pension Regulations was not allowed to VRS retirees in several banks though the terms of offer of VRS originally stated that Pension would be payable as per Pension regulations to those retiring through it. The offer was amended at the fag end of the offer period of VRS without giving an opportunity to the subscribers to withdraw subscription to VRS.

In Union Bank, during the Leeladhar Regime, the gratuity was paid in two instalments to VRS retirees. It was not the first time employees were retiring from the Bank so as to get the payment vitiated by a mistake. On bringing the matter to his notice, the Chief Executive embraced stupendous stupidity driving the employees to external agencies for corrigendum action. Ultimate result proved that the Bank had defrauded and consumed the sweat of the brows of those who had partnered with it in its growth. The amount was to the tune of Rs.600 Crores which the Bank embezzled from its own people who went out co-operating with the management that wanted to trim its size. Such illustrious deeds elevated its architect to the present position and provide inspiration and motivation to career oriented people to follow suit for achieving their goals.

The mischievous acts the dignitaries in the elite banking circles have committed would take to shame even scoundrels. Recently there was a press report about the Chairman of a PSB, upon reading an earlier report of an auto driver returning to the owner the articles he had forgotten in his cab, relaxing the margin norms and granting an auto rickshaw loan. If the auto driver comes to know that the banker is one who has deceived his own people who worked for the bank by not granting them their eligible pension, he would perhaps refuse the gift altogether.

The comforts they enjoy while staying in star hotels most often and elite living conditions must have made the bank executives forget the past entirely and think that others are also comfortable. Ageing does not bring in wisdom but contracts cataract to impair their vision instead of broadening it. An attempt to step into the shoes of a person who is denied his legitimate pension, which is the only means of living at the fag end of his life, may open the vistas of mind.

Instead of carrying out the legal obligation to extend fresh Pension option in the original form it was extended earlier. IBA is now conducting an actuarial exercise. In order that such an exercise shall be meaningful to some extent at least, in respect of those who are already in Pension stream, banks should contribute to the pension Fund an amount equivalent to what is held in the employee’s share of compulsory PF minus what has been transferred into the Pension Fund earlier, in 1995. In respect of those who retired already, the contributions till date of retirement minus what is transferred initially should be transferred. The Pension Funds will definitely have surplus after meeting all Pension obligations as the compulsory employees’ contribution to PF of all the fresh entrants to Pension will also augment the Pension Funds of banks significantly for meeting all pension obligations with ease and comfort..

Banks and IBA appear as not led by logic or reason and find money to squander in so many ways. They take the command of the political masters and stand in a line as obedient dogs for getting favours. Interest free loans to sugar sector and waiver of agricultural loans for poll prospects meet with their approval when they plead paucity of funds for basic items like Pension. The bankers who stand below the common umbrella of IBA pulled legs of each other for snatching away the business of counterparts, using the dreaded weapon of reduced interest rate debilitating the individual banks. Vital fluid of banks oozed out in thousands of kilo litres enfeebling the entire banking system. The vehement criticisms I put forth put an end to the brisk interest war in the latter half of 2006-2007. Ten to twenty percent of interest income banks generate now can reasonably be attributed as my contribution made to the banking system remaining outside it and without being remunerated and the key men who have been enjoying fat remuneration were dwindling the resources for their cosmetics of business promotion. It is only after making fantastic contributions and after strengthening the system that I am pleading for justice to grant me my Pension, a legitimate due, which is not a charity doled out to a retired employee at the sweet will of the employer.

What I appeal to you is that:

Decisions should be dictated by what’s right and not by what it might cost us to do what’s right. Don’t let mistakes and failings take you prisoner. Ask God for fresh inspiration and wings of faith to help you rise above them.

We are all dignified people who call as “father” the person who engendered us. It is our benign responsibility to honour all commits we made. Let our deeds reflect our quality. We are people who enforce substantive law with full vigor against bank defaulters. Let us not be defaulters before the same law that enables us to perform our roles. Let us correct all past mistakes that have come to our notice and not stick on to them on grounds that are not tenable. Let bankers not be cowards and moral bankrupts for doing the right. I B A should strive to be worthy of being called Indian Banks Association to protect the interest of the bankers lest fellow bankers may think in terms of calling it “Indian Bastards Association”. If you imagine yourself in my place for a while, you will be able to easily grasp my strong feelings in the matter and I am sure you will initiate swift befitting corrigendum action. Let us not attempt to patch holes with darkness. Let us grant Pension option with retrospective effect to all those who have the prescribed qualifying service (including the notional grace period) and strictly as per our own Pension Regulations. Let qualifying service be the criterion and not the mode of exit, especially when the latter is formulated by the bankers themselves for their advantage. Let us not waste time as time is precious and important.

Thanking You,

Yours faithfully,

C N Venugopalan

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment