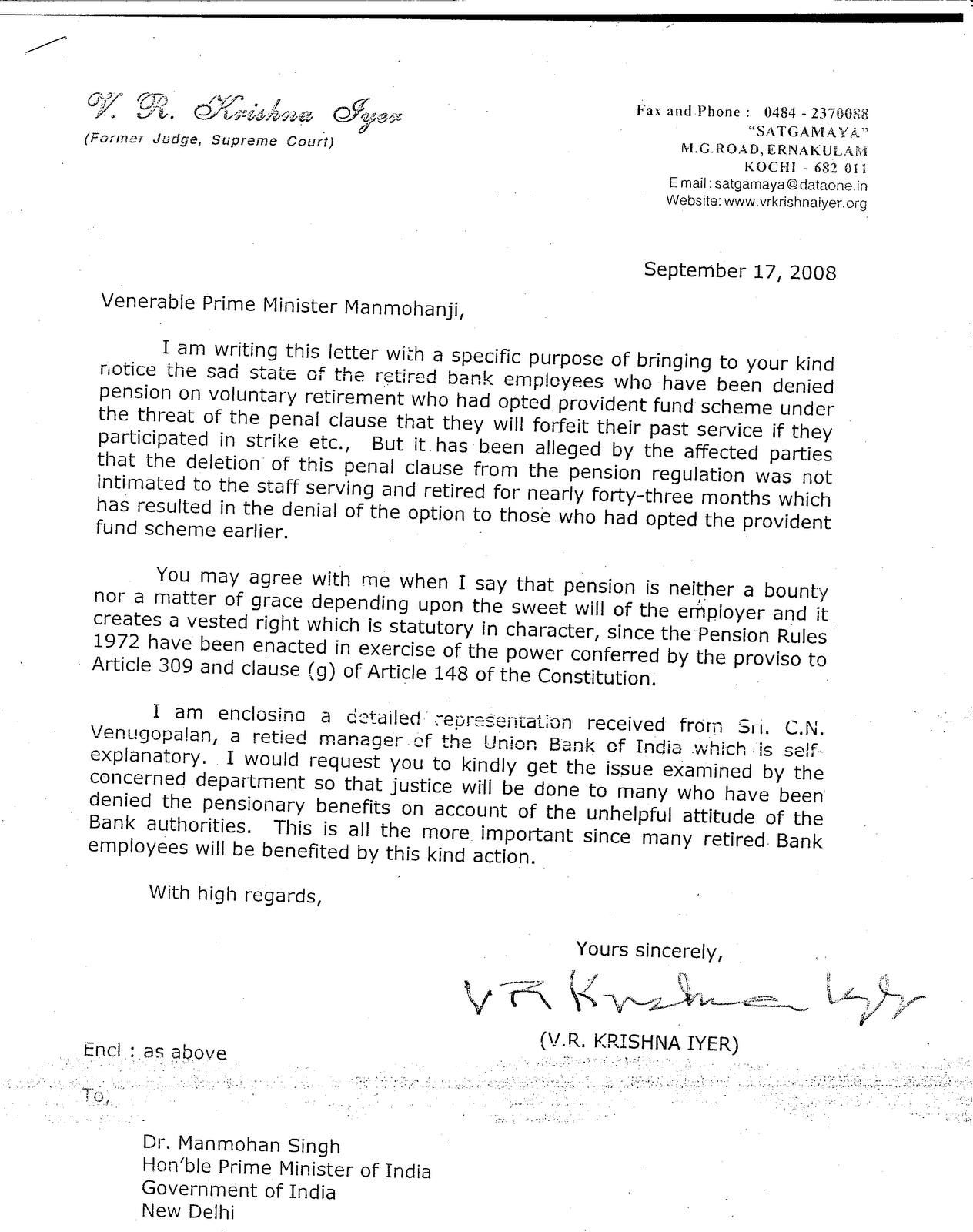

This is the first letter which prompted the trade unions to come forward with Pension issue that was already a dead one until January, 2006. The two strikes that took place in the industry is the result of it.

Attention: PF Optees (Officers & Workmen)

C N Venugopalan

Ex- Manager, Union Bank of India &

Co-ordinator of PF stream bank staff

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994 Email: cnvenu@yahoo.com

Comrade,

10th January, 2006

Mission 2006 - Securing Pension Option afresh

Fresh option for Pension to bank staff is becoming a seven-year-old issue to the PF stream of Bank employees that has to find an immediate solution. Trade Unions in Banks that have been after the matter all along have not so far delivered goods. Fresh Pension option occasionally finds a place in the charters of demands of workmen and officers’ trade unions as an item to support other issues or to sooth and comfort the members. Option is still remaining to be a mirage. The people who are eager to get it appear to have forgotten that unless the child cries it will not get milk. This basic issue has not attracted the attention and importance it deserves. The present status of the item can be due to a nexus between Bank Managements and Trade Unions at high level. Are the organizations not aware of PF option extended to RBI staff in the year 2000? The injustice meted out the PF segment in commercial banks is assuming a high magnitude with each Wage Revision. In each Revision, a substantial portion of the load factor is set apart for the Pension Fund. The managements of banks are taking a kick back and recouping a portion of the amount totally determined as hike. The residue alone is uniformly divided among the PF Optees and Pension Optees. The PF Optees stand to lose substantially each time when a wage pact is reached. In spite of the legitimate legal, moral and socio economic grounds, Trade Unions are not effectively fighting out the issue.

Why did we remain under Provident Fund Scheme?

At the time the Pension Scheme was commissioned in Banks, the leaders of the AIBOC propagated the message that if an officer had a residual service in excess of 9 to 10 years , the PF Scheme would be beneficial to him. This created confusion and even those who had originally opted for Pension in response to the draft Pension Scheme changed their minds and joined the P F Scheme back. Workmen organizations like BEFI also were vehemently propagating the benefits of P F Scheme and opposing members from joining Pension Scheme. The leadership of AIBOC and of the other Trade Unions cannot run away from the scene and they have every responsibility to correct the mistake they did for protecting the interests of those who have gone out under VRS as also the existing officer community and their families.

Plight of P F Optees

About one year back, in a meeting of Retired Bank Officers at Kochi inaugurated Justice V R Krishna Iyer, Shri. N P D Menon, President of the Retired Bank Officers of Kerala expressed his apprehension that the retired officers who are in Provident Fund Scheme, in the wake of the spiraling prices and the nose-diving interest rates, would have to go to the Thevara bridge and jump into the Arabian Sea for want of means to keep both ends meet. We all know, the rates of interest on Bank Deposits, Provident Fund, P P F etc. have eroded substantially and the expert advice of the leadership to remain in P F stream went wrong. Several employees who lived a decent living in the past now experience much hardships and it does not come to the surface since their dignity does not allow them to tell it to others. All have to retire one day or other and the situation should not happen to the existing officers and employees. It is high time the organizations of officers and workmen take immediate remedial steps to correct the mistake and allow the victims, both working and retired, to live peacefully by securing fresh option.

Grounds for Fresh Option

While calling for the Pension Option, the Pension Regulations contained a penal provision that in case of participation in strike, the management will have the right to forfeit the past service of an employee. With the exercise of the option, the entire PF contribution standing to the credit of an employee would lapse into the Pension Fund of the Bank. If the Managements forfeit the past services for participation in strike, the employee will have no qualifying residual service to earn any Pension. This was the main reason for majority of the employees not exercising the option in favour of the Pension Scheme. The Penal Clause was later scrapped from the Pension Regulations in the year 1999 vide Gazette Notification dated 27 02 1999 in response to Trade Union action. Unlike in the case of other amendments, the Bank did not bring this amendment to the notice of the employees by issuing a Circular among them, but kept the information in camera. The Trade Unions who got the penal clause removed from the Pension Regulations failed to secure along with it a fresh chance of option for those who did not join Pension Scheme because of the existence of the deleted clause in the Regulations. The purpose of the amendment was thus totally defeated. Though the Bank Managements have a statutory and moral onus of extending a fresh Option, they did not comply with the requirement. Trade Unions are dormant on the issue possibly on the thought that the additional burden may sometimes affect the present pension payment. Organisations forget the principle that co-existence or no existence is the dictum to be applied in such a case. They do not see Banks making sparkling profits year after year which can contain any additional burden with ease.. They are becoming a party to Banks robbing Peter to pay Paul every time a settlement is reached on Pay Revision. With each Pay Revision, the PF Optee loses heavily. Managements and Trade Unions created two separate classes of employees with two entirely different pay packets among equals doing the same work, sans natural justice and infringing fundamental rights enshrined in the Constitution of India. One should despise both - Managements and organizations – unless and until they discard the unfair policies into the Arabian Sea.

Absurdities in the Scheme

§ The Pension Scheme in Commercial Banks came on the same lines as in RBI. In RBI, a third option was given in 2000. Option was not given in other Banks.

§ Those who have participated in strikes before the deletion of the forfeiture of service clause in 1999 are, in fact, not entitled to pension as the Pension Regulations envisage forfeiture of past services for participation in strike. The amendment made through Gazette Notification dated 27 02 1999 had no retrospective effect and the clause was in full force and effect until its deletion. The recipients of Pension have participated in so many strike actions while the clause was operative and the banks ought to have forfeited their past services. The Pension now Banks pay is hence not a payment as per the Pension Regulations.

§ The Pension Scheme which was commissioned in Banks in 1995 gave coverage to all the employees who retired from Banks from 01 01 1986. All those who had retired nearly ten years back were given the benefit. The retrospective effect was to secure the interest of one person viz. Tharakeshwar Chakraborthy, the veteran Trade Union Leader. No one is concerned about the fate of the ordinary members who are now in the service of the Banks despite the legitimate legal, social and moral right and entitlement.

§ The Pension Scheme compulsorily encompasses all new recruits in the industry who are not in any way related to the industry so far. But those who are already in service and have contributed their mite for the progress of the organizations are not given a chanced for fresh option.

§ The Pension Scheme envisaged payment of Pension normally on attaining the age of 60. Banks extended triple benefits to Pension Optees who embraced Voluntary Retirement. They got –

1. Compensation calculated at 15 days of Salary for each year of completed service

2. Pension from the date of retirement, which would otherwise normally accrue after the age of 60

3. Well paid employment in other institutions – several in Banking Industry itself too.

This is in sharp contrast with the PF Optee who lost the Bank’s Contribution to PF, which was normally payable up to the age of 60 years to them. Most are devoid of any job and deserted in life too.

Actions afoot in the matter

§ A suit has been filed in the Hon’ble High Court of Kerala for effectively sorting out the issue. It bears the number 11108/2003. Early Petitions have been filed twice. The Court has not considered the first petition and the second one is likely to come up shortly. The plaintiffs are Mr. T K Baburaj, Mr. T K Chandramohan, Mr. John C Varkey and Mr. K Murali of Union Bank who have taken Voluntary Retirement. The outcome of the suit will benefit the retired as also serving. A similar petition has been filed by VRS retirees of Bank of India in the High Court of Kerala.

§ The undersigned has given a petition to Rajya Sabha duly countersigned by Mr. Thennala Balakrishna Pillai, M P, very vividly explaining the full details and the proportion of injustice.

§ The undersigned submitted a representation in detail clarifying the bad Pension Policy to the Hon’ble Minister for Finance. The MOF forwarded it to the Chairman of Union Bank of India. The Bank gave a reply to me without reviewing the bad policy and side tracking the crux of the matter. They just informed that the request couldn’t be acceded to at the juncture in the light of the policy obtaining in the Bank. The matter has again been taken up with MOF stating contempt of the Govt. directive and the outcome is awaited.

§ A Petition has been filed in the Lok Sabha through respected Mr. P C Thomas, Member of Parliament. The M P is taking up the issue in the Lok Sabha for getting a Committee of the Parliament appointed in the matter.

The latest settled legal position in the Supreme Court in its Constitution Bench is reproduced

Constitution Bench of Supreme Court in Nakara Case (17 12 2002)

“Pension is neither a bounty nor a matter of grace depending upon the sweet will of the employer and it creates a vested right which is statutory in character because the Pension Rules 1972 are enacted in exercise of the power conferred by the proviso to Article 309 and clause (5) of Article 148 of the Constitution”.

“That pension is not an ex-gratia payment but it is a payment for past services rendered”

“ It is a social welfare measure rendering socio-economic justice to those who in the hey day of their lives carelessly toiled for the employer on an assurance that in their old age they would not be left in the lurch. The pension payable to a government servant is earned by rendering long and efficient service and therefore can be said to be a deferred payment of the compensation for service rendered”.

“Pension is not a charity doled out to the retired employees, but is their legitimate and inalienable right earned by the sweat of their brows”.

Action Programme

As members are regularly paying the monthly subscriptions, pay revision levy etc. the organizations representing them appear to be under an impression that members hail the inertia towards securing a fresh option. Payment of subscription tantamount to the members subscribing fully to the deeds and policies as also the inertia of the organization. Let us make our disagreement known to them. Each one of you wants the fresh option. Let us clamour for our fundamental right. We allow a reasonable time up to June, 2006 to the organizations to focus the demand and resolve the long pending issue. In case they do not pay heed to the demand and take it up vehemently, let us decide to defer the subscriptions to organizations from July, 2006 onwards until such time the organizations focus attention to the grave issue and fight it out. No one wants an organization that cannot meet one’s basic need. Let us observe a “ Protest Day” and a “Demand Day” for pressing the demand. The badges to be worn and the format of letters to Management and to Organizations will be supplied in due course. Out of 150 comrades I met, only four had been neutral over the issue and the remaining 146 expressed their solidarity and preparedness to join the mission. The response is overwhelming. Our aim is clear. It has its own strength and sanctity. It will save several thousands of bank employees and their families by ensuring them social security. It has got legal and social support. Let us have faith in ourselves. Victory is ours. We will emerge victorious.

With revolutionary greetings,

Yours comradely,

C N Venugopalan

Co-Ordinator of PF Optees in Banks

Note:

Copies of this circular are being sent to the President, UBI Officers’ Asociation, Kerala, Mr. Govindarajulu, President of All India Union Bank Officers’ Federation, Mr. PK Sarkar, General Secretary of UBI Officers’ Federation, Mr. P V Mathew (Federal Bank), Member, Negotiating Committee with IBA etc. for their information and for taking it up effectively with Bank Management.

Vision 2006

Peace of mind, Security & Welfare of Bank Staff

Copies in Print

20,000

Targeted Copies

1,50,000

Expenses

Printing

20,000

Targeted expenditure

5,00,000

Stationery

15,000

( Giving allowance for batch mailing )

Post/Courier

50,000

Rush profuse contributions to make the mission a grand success. Remittance to be payable at Kochi

Traveling

20,000

Total

1,05,000

Rate of contribution envisaged : Officers Rs.500/- ClerksRs.250/- Sub staff Rs.100/-

After reading, please reach this to others affected who are on leave or to your counterparts at a different branch or bank

This is the first letter which prompted the trade unions to come forward with Pension issue that was already a dead one until January, 2006. The two strikes that took place in the industry is the result of it.

Attention: PF Optees (Officers & Workmen)

C N Venugopalan

Ex- Manager, Union Bank of India &

Co-ordinator of PF stream bank staff

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994 Email: cnvenu@yahoo.com

Comrade,

10th January, 2006

Mission 2006 - Securing Pension Option afresh

Fresh option for Pension to bank staff is becoming a seven-year-old issue to the PF stream of Bank employees that has to find an immediate solution. Trade Unions in Banks that have been after the matter all along have not so far delivered goods. Fresh Pension option occasionally finds a place in the charters of demands of workmen and officers’ trade unions as an item to support other issues or to sooth and comfort the members. Option is still remaining to be a mirage. The people who are eager to get it appear to have forgotten that unless the child cries it will not get milk. This basic issue has not attracted the attention and importance it deserves. The present status of the item can be due to a nexus between Bank Managements and Trade Unions at high level. Are the organizations not aware of PF option extended to RBI staff in the year 2000? The injustice meted out the PF segment in commercial banks is assuming a high magnitude with each Wage Revision. In each Revision, a substantial portion of the load factor is set apart for the Pension Fund. The managements of banks are taking a kick back and recouping a portion of the amount totally determined as hike. The residue alone is uniformly divided among the PF Optees and Pension Optees. The PF Optees stand to lose substantially each time when a wage pact is reached. In spite of the legitimate legal, moral and socio economic grounds, Trade Unions are not effectively fighting out the issue.

Why did we remain under Provident Fund Scheme?

At the time the Pension Scheme was commissioned in Banks, the leaders of the AIBOC propagated the message that if an officer had a residual service in excess of 9 to 10 years , the PF Scheme would be beneficial to him. This created confusion and even those who had originally opted for Pension in response to the draft Pension Scheme changed their minds and joined the P F Scheme back. Workmen organizations like BEFI also were vehemently propagating the benefits of P F Scheme and opposing members from joining Pension Scheme. The leadership of AIBOC and of the other Trade Unions cannot run away from the scene and they have every responsibility to correct the mistake they did for protecting the interests of those who have gone out under VRS as also the existing officer community and their families.

Plight of P F Optees

About one year back, in a meeting of Retired Bank Officers at Kochi inaugurated Justice V R Krishna Iyer, Shri. N P D Menon, President of the Retired Bank Officers of Kerala expressed his apprehension that the retired officers who are in Provident Fund Scheme, in the wake of the spiraling prices and the nose-diving interest rates, would have to go to the Thevara bridge and jump into the Arabian Sea for want of means to keep both ends meet. We all know, the rates of interest on Bank Deposits, Provident Fund, P P F etc. have eroded substantially and the expert advice of the leadership to remain in P F stream went wrong. Several employees who lived a decent living in the past now experience much hardships and it does not come to the surface since their dignity does not allow them to tell it to others. All have to retire one day or other and the situation should not happen to the existing officers and employees. It is high time the organizations of officers and workmen take immediate remedial steps to correct the mistake and allow the victims, both working and retired, to live peacefully by securing fresh option.

Grounds for Fresh Option

While calling for the Pension Option, the Pension Regulations contained a penal provision that in case of participation in strike, the management will have the right to forfeit the past service of an employee. With the exercise of the option, the entire PF contribution standing to the credit of an employee would lapse into the Pension Fund of the Bank. If the Managements forfeit the past services for participation in strike, the employee will have no qualifying residual service to earn any Pension. This was the main reason for majority of the employees not exercising the option in favour of the Pension Scheme. The Penal Clause was later scrapped from the Pension Regulations in the year 1999 vide Gazette Notification dated 27 02 1999 in response to Trade Union action. Unlike in the case of other amendments, the Bank did not bring this amendment to the notice of the employees by issuing a Circular among them, but kept the information in camera. The Trade Unions who got the penal clause removed from the Pension Regulations failed to secure along with it a fresh chance of option for those who did not join Pension Scheme because of the existence of the deleted clause in the Regulations. The purpose of the amendment was thus totally defeated. Though the Bank Managements have a statutory and moral onus of extending a fresh Option, they did not comply with the requirement. Trade Unions are dormant on the issue possibly on the thought that the additional burden may sometimes affect the present pension payment. Organisations forget the principle that co-existence or no existence is the dictum to be applied in such a case. They do not see Banks making sparkling profits year after year which can contain any additional burden with ease.. They are becoming a party to Banks robbing Peter to pay Paul every time a settlement is reached on Pay Revision. With each Pay Revision, the PF Optee loses heavily. Managements and Trade Unions created two separate classes of employees with two entirely different pay packets among equals doing the same work, sans natural justice and infringing fundamental rights enshrined in the Constitution of India. One should despise both - Managements and organizations – unless and until they discard the unfair policies into the Arabian Sea.

Absurdities in the Scheme

§ The Pension Scheme in Commercial Banks came on the same lines as in RBI. In RBI, a third option was given in 2000. Option was not given in other Banks.

§ Those who have participated in strikes before the deletion of the forfeiture of service clause in 1999 are, in fact, not entitled to pension as the Pension Regulations envisage forfeiture of past services for participation in strike. The amendment made through Gazette Notification dated 27 02 1999 had no retrospective effect and the clause was in full force and effect until its deletion. The recipients of Pension have participated in so many strike actions while the clause was operative and the banks ought to have forfeited their past services. The Pension now Banks pay is hence not a payment as per the Pension Regulations.

§ The Pension Scheme which was commissioned in Banks in 1995 gave coverage to all the employees who retired from Banks from 01 01 1986. All those who had retired nearly ten years back were given the benefit. The retrospective effect was to secure the interest of one person viz. Tharakeshwar Chakraborthy, the veteran Trade Union Leader. No one is concerned about the fate of the ordinary members who are now in the service of the Banks despite the legitimate legal, social and moral right and entitlement.

§ The Pension Scheme compulsorily encompasses all new recruits in the industry who are not in any way related to the industry so far. But those who are already in service and have contributed their mite for the progress of the organizations are not given a chanced for fresh option.

§ The Pension Scheme envisaged payment of Pension normally on attaining the age of 60. Banks extended triple benefits to Pension Optees who embraced Voluntary Retirement. They got –

1. Compensation calculated at 15 days of Salary for each year of completed service

2. Pension from the date of retirement, which would otherwise normally accrue after the age of 60

3. Well paid employment in other institutions – several in Banking Industry itself too.

This is in sharp contrast with the PF Optee who lost the Bank’s Contribution to PF, which was normally payable up to the age of 60 years to them. Most are devoid of any job and deserted in life too.

Actions afoot in the matter

§ A suit has been filed in the Hon’ble High Court of Kerala for effectively sorting out the issue. It bears the number 11108/2003. Early Petitions have been filed twice. The Court has not considered the first petition and the second one is likely to come up shortly. The plaintiffs are Mr. T K Baburaj, Mr. T K Chandramohan, Mr. John C Varkey and Mr. K Murali of Union Bank who have taken Voluntary Retirement. The outcome of the suit will benefit the retired as also serving. A similar petition has been filed by VRS retirees of Bank of India in the High Court of Kerala.

§ The undersigned has given a petition to Rajya Sabha duly countersigned by Mr. Thennala Balakrishna Pillai, M P, very vividly explaining the full details and the proportion of injustice.

§ The undersigned submitted a representation in detail clarifying the bad Pension Policy to the Hon’ble Minister for Finance. The MOF forwarded it to the Chairman of Union Bank of India. The Bank gave a reply to me without reviewing the bad policy and side tracking the crux of the matter. They just informed that the request couldn’t be acceded to at the juncture in the light of the policy obtaining in the Bank. The matter has again been taken up with MOF stating contempt of the Govt. directive and the outcome is awaited.

§ A Petition has been filed in the Lok Sabha through respected Mr. P C Thomas, Member of Parliament. The M P is taking up the issue in the Lok Sabha for getting a Committee of the Parliament appointed in the matter.

The latest settled legal position in the Supreme Court in its Constitution Bench is reproduced

Constitution Bench of Supreme Court in Nakara Case (17 12 2002)

“Pension is neither a bounty nor a matter of grace depending upon the sweet will of the employer and it creates a vested right which is statutory in character because the Pension Rules 1972 are enacted in exercise of the power conferred by the proviso to Article 309 and clause (5) of Article 148 of the Constitution”.

“That pension is not an ex-gratia payment but it is a payment for past services rendered”

“ It is a social welfare measure rendering socio-economic justice to those who in the hey day of their lives carelessly toiled for the employer on an assurance that in their old age they would not be left in the lurch. The pension payable to a government servant is earned by rendering long and efficient service and therefore can be said to be a deferred payment of the compensation for service rendered”.

“Pension is not a charity doled out to the retired employees, but is their legitimate and inalienable right earned by the sweat of their brows”.

Action Programme

As members are regularly paying the monthly subscriptions, pay revision levy etc. the organizations representing them appear to be under an impression that members hail the inertia towards securing a fresh option. Payment of subscription tantamount to the members subscribing fully to the deeds and policies as also the inertia of the organization. Let us make our disagreement known to them. Each one of you wants the fresh option. Let us clamour for our fundamental right. We allow a reasonable time up to June, 2006 to the organizations to focus the demand and resolve the long pending issue. In case they do not pay heed to the demand and take it up vehemently, let us decide to defer the subscriptions to organizations from July, 2006 onwards until such time the organizations focus attention to the grave issue and fight it out. No one wants an organization that cannot meet one’s basic need. Let us observe a “ Protest Day” and a “Demand Day” for pressing the demand. The badges to be worn and the format of letters to Management and to Organizations will be supplied in due course. Out of 150 comrades I met, only four had been neutral over the issue and the remaining 146 expressed their solidarity and preparedness to join the mission. The response is overwhelming. Our aim is clear. It has its own strength and sanctity. It will save several thousands of bank employees and their families by ensuring them social security. It has got legal and social support. Let us have faith in ourselves. Victory is ours. We will emerge victorious.

With revolutionary greetings,

Yours comradely,

C N Venugopalan

Co-Ordinator of PF Optees in Banks

Note:

Copies of this circular are being sent to the President, UBI Officers’ Asociation, Kerala, Mr. Govindarajulu, President of All India Union Bank Officers’ Federation, Mr. PK Sarkar, General Secretary of UBI Officers’ Federation, Mr. P V Mathew (Federal Bank), Member, Negotiating Committee with IBA etc. for their information and for taking it up effectively with Bank Management.

Vision 2006

Peace of mind, Security & Welfare of Bank Staff

Copies in Print

20,000

Targeted Copies

1,50,000

Expenses

Printing

20,000

Targeted expenditure

5,00,000

Stationery

15,000

( Giving allowance for batch mailing )

Post/Courier

50,000

Rush profuse contributions to make the mission a grand success. Remittance to be payable at Kochi

Traveling

20,000

Total

1,05,000

Rate of contribution envisaged : Officers Rs.500/- ClerksRs.250/- Sub staff Rs.100/-

After reading, please reach this to others affected who are on leave or to your counterparts at a different branch or bank

No comments:

Post a Comment