Thursday, September 25, 2008

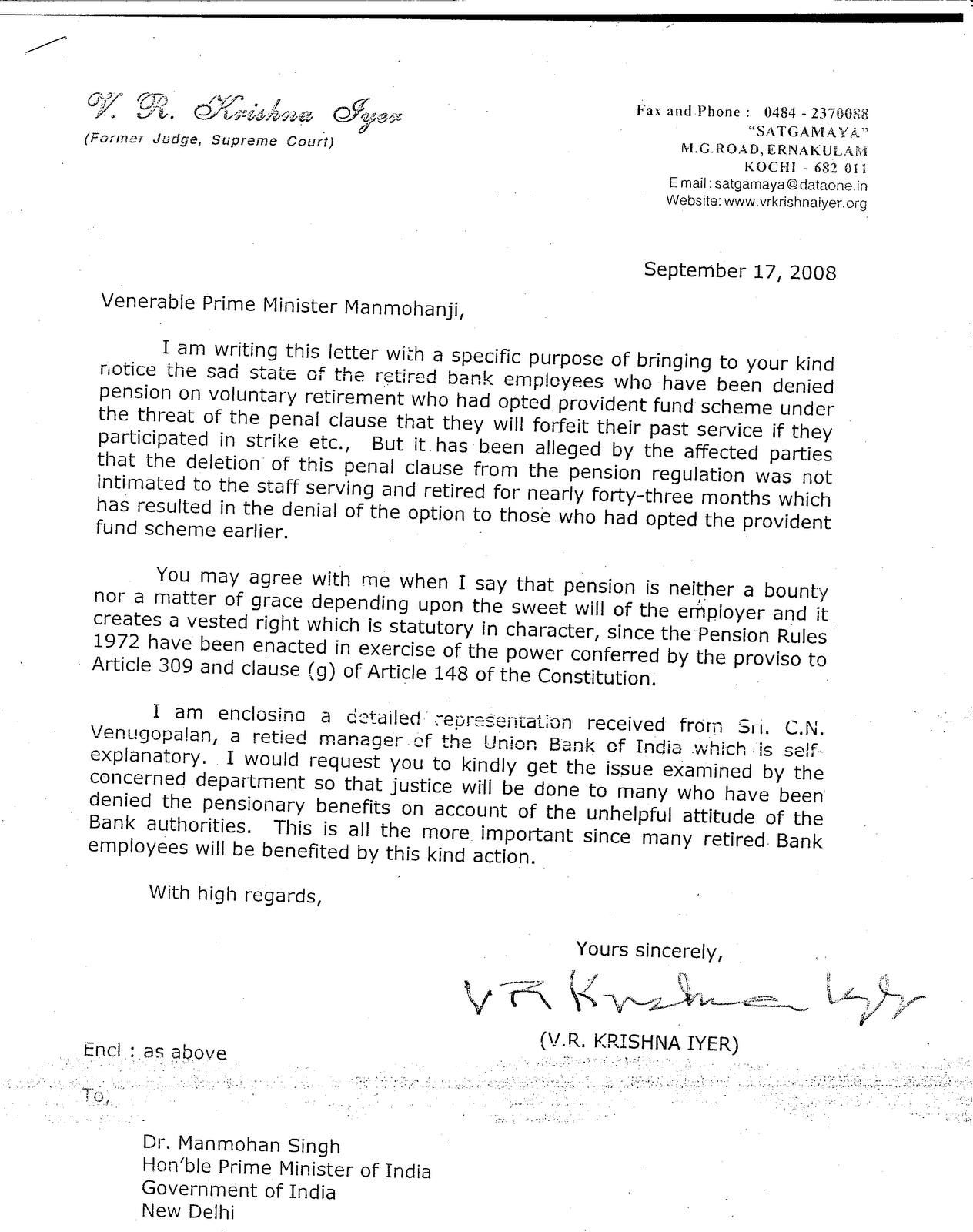

Letter to Prime Minister ( Recommended by Former Judge of Supreme Court

C N Venugopalan

Ex-Manager, Union Bank of India &

Vice President UBI Retired officers’ Association (Kerala)

Nandanam

Kesari Junction,

N Parvoor,

Kerala – 683 513

Phone. 0484 2447994 Mob: 9447747994 E-Mail: ceeyenvee@gmail.com

No. 20080916 16th September, 2008

Hon’ble Prime Minister of India,

Office of the Prime Minister,

Government of India,

Parliament Street,

New Delhi – 110 001

Respected Sir,

Denial of pension to majority of bank employees including me –

I was working as Officer MMJS-II in Union Bank of India with employee No. 028506 and I retired through Voluntary Retirement Scheme, 2001 on 20th April, 2001 after putting in 30 years of service in the Bank sans Pension benefit.

I had appraised you the injustice the Banking Industry meted out by denying Pension to a number of retired employees like me vide my letter dated 10th January, 2007. I regret to note that although your office was kind enough to forward my letter to the Secretary, Financial Sector, Ministry of Finance vide letter. PMO No ID No. 09/ 3 / 2007-PMP-4/750170 dated 22-JAN-2007, it received scant attention and no outcome has arisen. Whereas pension is not a new benefit to be given but is a benefit already granted by the Government in 1995 to employees, the denial of the benefit has arisen only through the wrong, illegal and whimsical implementation of the scheme.

Pension scheme on the lines available to central government employees was sanctioned in Banks in 1995. CPF scheme simultaneously continued for making available the existing benefit to those who could not secure prescribed minimum service of 20 years. Majority of employees are outside Pension Scheme now as a result of faulty and unlawful implementation of the scheme. Draft Pension Regulations published as also the final Regulations sanctioned by the Central Government called for options to be exercised within a prescribed date. When Final Regulations, contained a harsh clause enabling banks to forfeit the entire past services of an employee for participation in strike, (in variance from the draft regulations), many who opted earlier wished to come out and others who had not opted in terms of the draft did not join for fear of losing CPF and Pension if bank forfeited past service. Later, when the harsh clause was deleted from the Regulations on 27th February, 1999 following trade union pressure, options of those who took exit were not reinstated and others who had not opted on account of its infusion in final Regulations were not given fresh option. The amendment without specifying any effective date has effect from the inception of the scheme and the variation in offer terms vested with all a right to fresh option. Yet banks flouted fundamental principles of law and natural justice and did not give fresh chance of option. Banks thus meted out gross injustice to majority of bank men by denying Pension, the only source of income on cessation of employment and a right akin to fundamental rights of an employee.

Banks that usually circulated all amendments for information of employees before publishing in gazette kept the particular amendment in dark for enormously long time of 43 months and afterwards circulated it in a casual and stealthy way without taking individual acknowledgement as per practice in force. In Union Bank of India, the amendment of 27th February,1999 was published only on 8th October, 2002, after a time gap of 43 months. Many who retired in the meantime especially though VRS in April, 2001 had no information at all about it.

The scheme Government sanctioned contained no provision for revocation of an exercised option and had categorically stated that “an option, once exercised shall be final and irrevocable”. Yet, upon an advice from Indian Banks Association, (IBA) banks extended a chance and revoked options exercised in terms of the draft Regulations. IBA, a mere body of the bankers intercepted the authority of the Central Government by revoking the options exercised by the employees that were final in character. The revocation has taken place at the behest of IBA without taking previous sanction of the Government and without the Boards of Banks amending the regulations suitably. The process is null and void as IBA can not supersede the Central Government and / or the Board of the bank that adopted the Regulations. Even assuming that the process of revocation was a valid one, it has taken place when the harsh clause for forfeiture of entire past service was infused in the final regulations and the options had to be reinstated when the particular clause was deleted.

In short, those who had revoked their options and those who did not opt for the scheme when the harsh clause was inducted are having a legal right to get fresh option. Now it is strange that the Government is conducting feasibility studies for extending Pension Option as if it is a new benefit to be sanctioned. By not granting it in the original form to all those who have prescribed qualifying service, the Government and Banks are evading their own commitment to the employees and forcing them to agitate over the issue that is nearly a decade old one now.

The regulations did not have provision to pay pension before attaining the age of 60 and to employees with less than 20 years of service. However, Banks paid pension to such category that retired through VRS without enabling provisions. To escape accountability of unauthorized erroneous payments regulation 28 was amended on 13th July, 2002, reducing the qualifying service from 20 years to 15 years and vesting pension in premature retirement cases. This beneficial amendment too created an obligation for extension of fresh option especially to those who did not opt earlier.

Pension Scheme that took in its orbit all those who retired 9 years back from its inception by taking back the CPF paid on retirement and compulsorily encompassed all future recruits without any contribution from their side ironically denied the benefit to majority who were on the rolls at the time of inception of the scheme in 1995. Banks, whose profits contribute to the exchequer and partly meets the pension of government employees and statesmen, deny the benefit to their own employees by implementing pension scheme in a wrong way, flouting principles of law and natural justice.

Bank offices all over the country remained shut for three days during the last two years causing inconvenience to the public since Banks and IBA, drove the work force out of their seats on the issue of Pension Option. Another call for strike on September 24 & 25 is given by United Forum of bank Unions since the memorandum of understanding to resolve the issue within three months also is breached. Banking system is likely to get paralyzed once again. The blind trespass of bureaucracy into the pastures of simple and natural justice makes one feel that independence is a mirage even in the seventh decade of freedom.

I earnestly request you to intervene in the matter expeditiously and to direct the Ministry of Finance to examine details in the true perspective for rendering justice to all retired employees who are left in the lurch now by granting them the benefit of pension through proper implementation of the scheme in operation.

Thanking You,

Yours faithfully,

C N Venugopalan

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment