Thursday, September 25, 2008

Letter to IBA

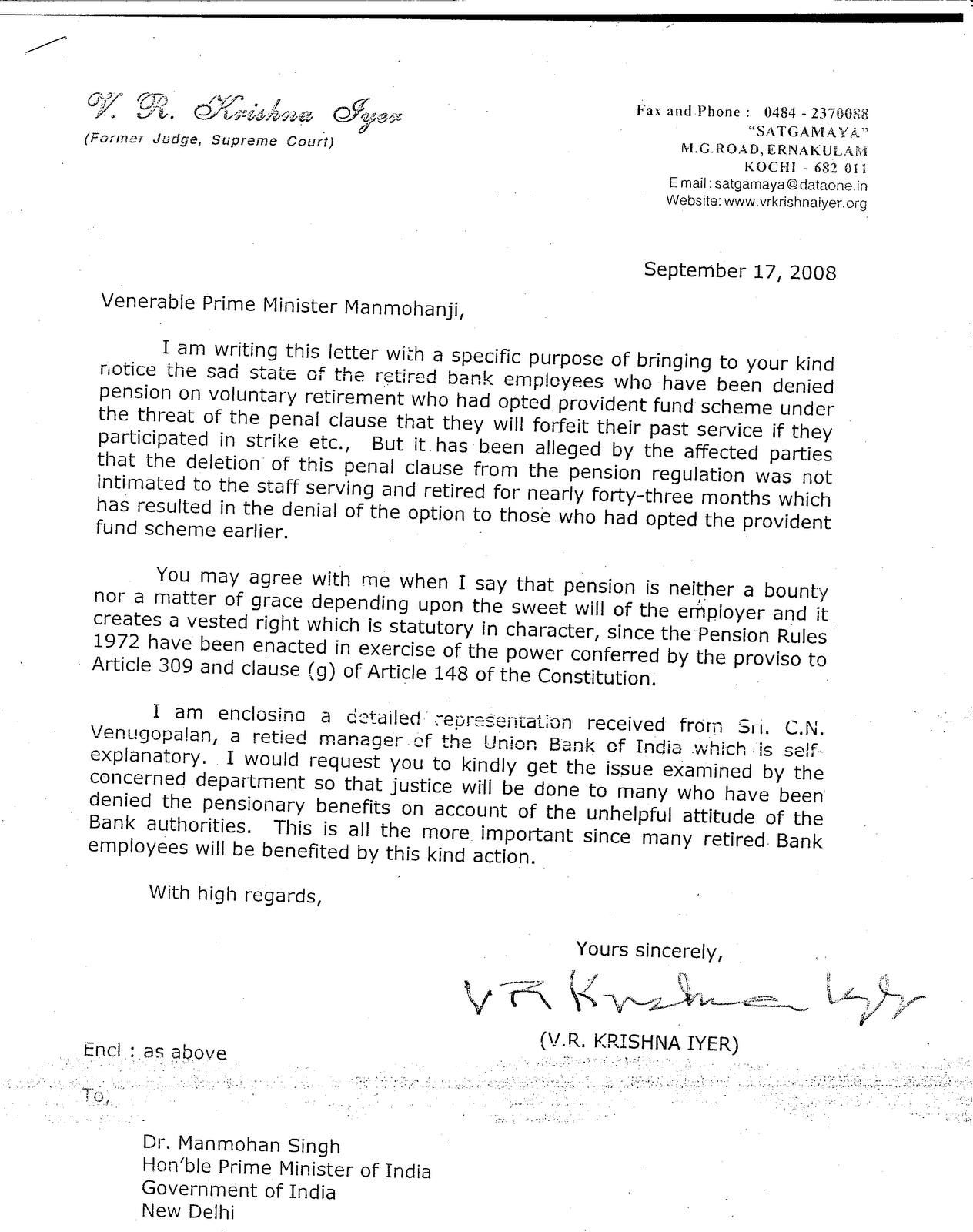

C N Venugopalan

Ex- Manager, Union Bank of India

& Financial Consultant

“ Nandanam”

Kesari Junction

North Paravoor

Kerala – 683 513

Phone No. 0484 2447994 Mobile: 9447747994

The Chairman, 14th March, 2006

Indian Banks Association,

Block No. 2 & 3,

6th Floor, Stadium House,

81-83, V N Road,

Mumbai – 400 020

Dear Sir,

Pension Option in Banks and its imperative need

You must have received my earlier letter dated 6th February, 2006 regarding extension of Pension Option afresh to employees in Banks.. Though silence cannot be construed legally as a mode of acceptance, I am glad that none of my statements have been contradicted. The Prime issue that looms large in the Banking Horizon invariably is that of a fresh Pension Option. Fresh Option for Pension is already a committed item in view of the legal onus cast on Banks on account of the scrapping of the Forfeiture of service clause from the Pension Regulations of the Bank. The option given in RBI in 2000 is another compelling reason. Pension is in no way a consideration for a simple option exercised. It is the consideration for services rendered. The emphasis the Constitution Bench of the Supreme Court has assigned to the right of an employee to Pension in Nakara Case (17 12 2002) is also a statute that reinforces the issue. The decision is an indirect statute that has a bearing on the Banking Industry and has to be honoured. It is utterly surprising that IBA that watches all legal decisions affecting Bankers and bring them out in its journal has not taken any steps to fall in line with the decision. Ignorance of law is no excuse and non-compliance with the statute is contempt of Court. While commissioning Pension Scheme in 1995, Banks had ridiculously went to the extent of including under it, all those who retired on or after 01 01 1986, (about one decade) just for paying Pension to one Tharakeswar Chakraborthy, the veteran Trade Union leader who retired in the year 1986. From the angle of significant accounting policies, the correct determination of profit of Banks requires provision of all expenditure including legitimate establishment expenses like Pension. Since a number of suits are in the Courts regarding Pension Payment, it becomes inevitable that adequate provision be made in the books for Pension liability for ascertaining the exact profit figures of Banks. Distributing the inflated profit without adeqauate provisioning is totally unscientific and tantamount to robbing Peter to pay Paul. Extension of fresh option is something, which has to be done invariably and which can be done without Banks incurring any additional costs. The following will give a very vivid picture:

1. At the time of commissioning Pension Scheme, Banks had the liability to make PF Contributions in respect of all employees on the rolls in 1995 till their retirement. This was an already committed cost. Such contributions could notionally be worked out and ploughed back into the Pension Fund to augment it.

2. In respect of those who are recruited (who are encompassed by the Pension Scheme compulsorily) also, keeping the pay package at the same level, the contributions could be put into the Pension Fund.

3. The balances available in the PF accounts of the present PF stream employees who may opt for Pension through fresh Pension Option and the future contributions in respect of till their retirement (which was also a committed cost of the Banks at the time of commissioning the Pension Scheme) should also be made available for augmenting the Pension Fund.

4. Judicious investment of all the moneys will ensure substantial returns that will augment the Pension Fund substantially

5. The exercise pertaining to the above three items have to be worked out for the past one decade and transferred into the Pension Fund.

6. All the employees who opt for Pension are not going to retire in a lot and create a Pension Obligation for the Banks and the liability will be growing only in a phased manner. On account of death and other cessation of Pension of the present pensioners, cessation of family Pension, the liability will be getting extinguished in several cases and some sort of balancing will be available in the process.

7. A fresh Option will ultimately result in substantial establishment expenditure as it may induce a number of employees to quit the present jobs with a less attractive compensation package.

8. Option to remain in PF in other words should be retained as a terminal benefit to only those who need it for personal some personal reasons or to those who will not have qualifying service to be eligible for Pension.

Financial Constraints –an illusion

It was true that some of the Banks like Syndicate Bank, UCO Bank Indian Bank etc were ailing ones a decade back. All of them have turned corner and some have shown fantastic working results. Want of paying capacity is not at all there. Banks shed several crores through write off and relief to defaulters in circumstances that are not genuine in many a case. Ground rules and code of ethics in business are forgotten altogether. In the name of competition, for applying cosmetics to the performance, the prodigal banking barons drain out plenty of Crores every year. On one side they join hands together by sharing ATMs and establish common service network and the other side they pull the legs of one another. Banks competing with each other take over advance accounts from others by offering lesser and lesser rates. The customers who have bargaining power gain and the amounts they gain represent loss of vital fluids of the industry. The deregulated rates of interest further offer scope for corruption and nepotism. The deserving poor never get a fair treatment. The other industries like those of Ambanis, Birlas, Dalmia, Tatas etc flourish and their workmen also get all good perquisites. The banks which finance in furtherance of such industries do not have capacity for paying Pension to the staff who toiled through and through for their organizations. What a pity? The amounts payable to them by way of establishment expenses are drained out of the industry in several Crores. The benefit is accruing to the key men heading the different Banks alone. RBI and the Government have no control and they sit enjoying like watching a Cricket.

We are also aware, several Banks including a PSB viz. New Bank of India monitored by RBI and controlled by stalwarts in the industry vanished into obscurity. Paravoor Central Bank Ltd., Nedungadi Bank, Bank of Madura etc. are some of them. Where is the control and what is the control? Where is the integrity of the key men who run the Banks? Banking industry has provision to contain such gigantic losses arising out of manipulations and mismanagement. There is however no money to provide bread and butter to those who toiled and sacrificed their entire career for the organizations they served

Thanks to the Information Act, 2005, one can requisition information relating to the take over accounts from any Bank and ascertain the extent of money thrown out for keeping the false prestige and cosmetics of the stars in the industry and publish it in media columns.

Again, money goes out from the system to safeguard the blunt and blatant policies of the executives. To cite a simple example, the terms of offer of VRS contained an offer to pay Pension to those who embraced the scheme as per the Pension Regulations. Pension Regulations contained a provision to allow grace period of five years to those having 28 years of service. Banks did not honour the commitment and arbitrarily disallowed the notional grace period. When some Pensioners obtained a favourable decree, BOI took the matter to the Apex Court knowing for certain the hollow nature of the suit just for preventing and delaying the flow of justice to the decree holders. Their action has caused inconvenience and loss to a lot of people, including some who are not directly involved. The Bank is trying to patch a hole with darkness and playing the game with the public money at its command. The decision makers capitalize out of the fact that they do not have to spend anything out of pocket, but just have to take a decision. The matter is simple and does not involve any intricate legal issue. Banks are used to making a mockery of the Court also. There exists good scope for a PIL petition in the matter invoking the concerned Bank.

As for me, it was the humiliating experiences with the employer that forced me to quit the employment through VRS at a young age of 49. After rendering yeoman service for about 30 years, the employer sent me out without hosting even a cup of tea. The Bank had provisions to expend a sum of Rs.200/- when an employee retires. The Bank informed all administrative offices that VRS retiree is not entitled to the expenditure in spite of the fact that it is not an amount paid to the employee but an expenditure incurred by the Bank itself for holding a small get together meeting. Again, the Bank did not pay the amount of gratuity correctly and in time. The top executives lent a deaf ear to the entreaties. Ultimately, the issue had to be taken to the Labour Department to get redressed. The claim was confirmed and the Bank paid about Rs.5 .00 Crores to all the VRS retirees taken together and my share was about Rs.17, 000/-. What a pity on the part of great institution in making an unholy profit out of the sweat of the brow of an employee!

Besides, after applying for Voluntary Retirement, the Bank declined the Privilege Leave applied for with due notice citing exigency of service at a time it had identified surplus manpower and came with a scheme for shedding surplus manpower. I was having maximum PL accumulation and the period of leave declined was not added to my PL account. In fact, at the fag end of my career, I was not paid for 15 days of work the Bank forcibly and arbitrarily extracted. Likewise, whereas the Service Regulations provided for a mandatory three months notice on either side for quitting / expelling, I was intimated about acceptance of my Voluntary Retirement application on 30th March, 2001 and the employer relieved me on 20th April, 2001. A sum equivalent to 70 days pay is still due to me as pay in lieu of notice. The promised compensation payable within a maximum period of 21 days was not given to me in full. I had accepted the capital forbearance of my future services of about 10 years’ future service in anticipation of the promised compensation, it was not paid in full yet. I had to issue a notice of demand to the employer demanding the remaining amount and on the expiry of the notice period the amount already paid under VRS was forfeited. The VRS has hence become null and void and I am deemed to be in the services of the employer as on date. A suit is in the High Court and the decision is awaited. The matters are made known to you without prejudice to the suit filed in the Court merely to apprise you of the shallow games of Banks. I have to pursue some work or other until the normal age of retirement at least and hence indulging in it to do some good to the industry that brought me up. And my strength is that of millions since my cause is just and legal.

Coming back to the point, I further state that the Trade Unions in Banks are charged with the issue of fresh Pension Option and come out with it any time. In the wake of the legitimacy of the requirement for grounds enumerated, if people heading the Banks and IBA are sensible people, they have a responsibility to come forward to allow the just right of the employees who were on the rolls of Banks in 1995 to have a fresh option instead of unnecessarily making a trial of strength bargaining on the legitimate issue and conceding later. It is a matter to be known whether those concerned would develop the wisdom to come forth voluntarily for settling the issue amiably or remain power blind and take recourse to the precedents of succumbing to the trade union pressure later. If Banks led by IBA is showing an untoward attitude despite bringing to your information about the verdict of the Constitution Bench of Supreme Court, I will be free to move a PIL petition in the Apex Court explaining all the circumstances very vividly for averting the threat of disruption of normalcy in Banking and inconvenience to the public besides bringing it in media and before the Government.

A copy of this letter is being sent to RBI also for its information.

Yours faithfully,

C N Venugopalan

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment